四月份 ETH 的收益表现远超 BTC,ETH-BTC 交易对汇率从 0.03 一路上涨至 0.06,市场上有关“以太坊市值超越比特币/Flippening”的口号和观点又开始活跃起来。

April & nbsp; ETH far outperformed & nbsp; BTC, ETH-BTC transactions from 0.03 all the way up to 0.06, the slogans and views in the market about “The market value of Taipan goes beyond Bitcoin/Flippening” were again active.

但值得注意的是,“以太坊市值超越比特币/Flippening”的这个口号在2017年就产生了,当时牛市阶段,虽然比特币一直稳坐币王宝座,但其的市值占比不断下降,许多以太坊爱好者就灵机一动,喊出了“Flippening”的口号,认为以太坊依靠其智能合约平台的无限可能,能够实现弯道超车。不过这几年依旧是被比特币压制得服服帖帖的。

It is worth noting, however, that the slogan “Bitecoin/Flippening” was created in 2017, when the bull market stage, where bitcoin had been sitting on the throne of coins, had a declining market value, and many of the followers of the taupulega, calling out the slogan “Flippening” and saying that it was possible to bend over the road by relying on its smart contract platform. But it was still years that Bitcoin was silenced by bitcoin.

那为何这阵子口号又继续喊起来了呢?当然不是 ETH-BTC 交易对汇率上涨的原因,甚至汇率上涨是果非因,本质上是以太坊社区内外的用户预见了未来以太坊基本面的优化,强化了对以太坊的信心,而价格汇率自然就是信心的外在表现。

So why do these slogans continue to shout? Of course not the ETH-BTC deal is not the reason, or even the result, of the exchange rate rise, essentially because users within and outside the Taiyan community have foreseen the future of the Ether fundamentals, strengthening confidence in Ether, and the price exchange rate is, of course, an external expression of confidence.

而这种基本面的优化,可以分为两类:

Such fundamentals can be optimized in two categories:

经济基本面:PoS过渡、EIP1559提案执行、ETH 成为通缩货币。

Economic fundamentals: PoS transition, EIP1559 proposal implementation, ETH becoming a deflationary currency.

生态基本面:DeFi、NFTs 等生态的繁荣以及传递出来的无限可能性;

The ecological fundamentals: the ecological prosperity of the DeFi, NFTs, etc., and the unlimited potential for transmission;

下文,我们将深入详细分析这两种基本面,试图分析一下“以太坊市值超过比特币”未来的可能性。

Below, we will undertake a detailed analysis of these two fundamentals and try to analyse the possibility of the future of “the market value of the Taiwan beyond Bitcoin”.

经济基本面

PoS 过渡 + EIP 1559 提案执行 = ETH 转变为通缩货币;

Pos transition & nbsp; + & nbsp; EIP 1559 proposal execution = & nbsp; ETH conversion to deflationary currency;

ETH 通缩货币 + 作为生态基础货币所产生的货币溢价= Ultra Sound Money(终极健全货币)

ETH deflationary currency & nbsp; + & nbsp; currency premium as ecological base currency = & nbsp; Ultra Sound Money (finally sound currency)

以太坊在 PoW 阶段,ETH 更多的是效用型代币,最主要的作用就是充当 Gas 用于支付手续费。在生态应用的繁荣下,ETH 作为以太坊生态的基础代币,也捕获着些许货币溢价。

The Etherms are more effective in the & nbsp; PoW phase, and the most important role is to act as Gas to pay the fees. In the boom of ecological applications, ETH also captures a few currency premiums as a token of the foundation of the Tails.

当前 ETH 的总量没有上限,每日 PoW 区块奖励发行约 13,500 ETH,年通胀量约为 4,927,500 ETH,年化通胀率约为 4.2%。

The current total of ETH is not capped at per day; PoW block incentive distribution about 13,500 & nbsp; ETH, annual inflation about 4,927,500 & nbsp; ETH, annualized inflation about 4.2% & nbsp;

作为总量不断上涨的币种,以太坊除了充当手续费的效用以及捕获自身作为基础代币的货币溢价,很难捕获其他方面的价值,特别是在价值存储这一块价值。而比特币作为总量恒定的代币,其代币价值就能充分捕获着“价值存储”这一块的货币溢价。

As a currency with a rising volume, it is very difficult to capture other values, especially the value that is stored as a constant currency. As a constant currency of the aggregate, the value of the coin captures the full value of the “value-storage” currency premium.

EIP 1559

如果 EIP1559 提案顺利在 7 月份执行,那么 ETH 将踏出作为通缩货币的第一步。

If & nbsp; EIP1559 proposals go well in 7 monthly implementation, then ETH will step out as a first step towards deflationary currency.

EIP1559 提案将原本的 Gas 手续费结构分为两部分:基础手续费(BaseFee)和矿工小费(Tip),其中基础手续费将全部销毁:

EIP1559 proposal to split the original & nbsp; Gas fee structure into two parts: Basic Fees (BaseFee) and Miner tip (Tip), in which all basic fees will be destroyed:

根据以太坊协调员 Justin Drake 给出的参考参数,基础手续费预计占据手续费结构中的 70%;

According to the reference parameters given by the Etherm Coordinator & nbsp; Justin Drake, the basic fees are expected to account for & nbsp in the fee structure; 70 per cent;

参考借鉴当前以太坊的每日手续费收入为 10,000 ETH;

The reference is & nbsp; 10,000 & nbsp; ETH;

那么 EIP1559 提案执行后,每年销毁的手续费大约为 10,000 * 365 * 0.7= 2,555,000 ETH;

& nbsp; EIP1559 after the implementation of the proposal, the annual cost of destruction is approximately 10,000 * & nbsp; 365 * & nbsp; 0.7 = & nbsp; 2,555,000 ETH;

通胀率大致从 4.3% 下降为 2.1%;

Inflation has dropped from about 4.3%; 2.1%;

由上可知,理想状态下,若 EIP1559 成功执行,ETH 相当于执行了一次减半,通胀率将下降至 2.1%,接近当前的比特币通胀率 1.8%。

It is clear from the above that, ideally, if & nbsp; EIP1559 successful implementation, ETH is equivalent to a one-time reduction in the rate of inflation to 2.1 per cent, close to the current bitcoin inflation & nbsp; 1.8 per cent.

PoS

过渡到 PoS 是 ETH 成为通缩货币的第二步。若届时以太坊网络成功切换到 PoS,那么:

Transition to & nbsp; PoS is & nbsp; ETH is the second step to become a deflationary currency. If you switch to & nbsp; PoS with the Taiwan network, then:

不再有 PoW 出块奖励,网络唯一的通胀来自于增发奖励给验证者节点的 ETH;

There is no more PoW gives a piece of incentive, and the only inflation in the network comes from the & nbsp; ETH that gives an increased incentive to the certifier node;

目前存储合约中已经约 4.4M ETH,我们假设届时质押合约余额将达到 10M ETH,根据官方给出的数据,届时的通胀量约为 490,000 ETH,通胀率约为 0.42%;

About & nbsp; 4.4 M ETH, at which time we assume that the balance of the pledge contract will reach 10M ETH, at which time, according to official figures, inflation is about 490,000 & nbsp; ETH, inflation is about & nbsp; 0.42%;

值得注意的是,EIP1559 提案每年会销毁约 2,555,000 ETH,抵消 PoS 每年 490,000 ETH 的通胀奖励,也就是说,过渡到 PoS 后,结合 EIP1559 提案,ETH 每年将减少约 2,000,000 ETH,每年约通缩 1.7%。

Notably, EIP1559 proposal to destroy approximately 2,555,000 ETH, offset & nbsp; PoS, 490,000 ETH, inflation incentive, i.e., transition to PoS, combined with EIP1559 proposal to reduce about 2,000,000 ETH, about & nbsp; 1.7%.

至此,在 EIP1559 提案和 PoS 转型的助攻下,ETH 将进入总量通缩的时代。目前圈内都认为总量恒定的比特币是一种健全货币,那么进入通缩的 ETH,将是一种超级健全货币,即"Ultra Sound Money"这个叙事的由来。

So, with the help of EIP1559 proposals and PoS transition, ETH will enter the era of volume deflation. The current circle considers the constant amount of bitcoins to be a sound currency, then ETH will be a supersound currency, i.e. 34; Ultra Sound Money #34; the rationale for this narrative.

其实在以太坊国外社区,最早正式公开讨论这个叙事的,应该算是知名以太坊爱好者社区 Bankless 与以太坊协调员 Justin Drake 的访谈视频,从那时候起(3月22日),这个叙事才正式开始流传开,而 ETH-BTC 交易对的汇率,也是从那时候开始上涨的,也算是一种价格发现了。

Indeed, in the community of Etheria abroad, the first people to officially discuss the story publicly were known as the community of the Etherkats & nbsp; Bankless and the Etherkat Coordinator & nbsp; Justin Drake, and since that time (22 March), the story has officially begun to spread, and & nbsp; the exchange rate for ETH-BTC transactions has also risen since that time, and it is a price discovery.

因此,综上所述,从经济基本面来看,EIP1559的执行以及PoS的切换,将从根本上改变 ETH 的货币政策,使其具备与 BTC 一样的价值存储属性。而除了价值存储的功能,ETH 还拥有 BTC 无法拥有的繁荣生态。

Thus, in summary, the economic fundamentals of EIP1559 and the PoS switch will fundamentally change the monetary policy of ETH to the same value storage attributes as BTC. In addition to the value storage function, ETH also owns & nbsp; BTC has a booming ecology that it cannot possess.

生态基本面

现在的比特币还是以前的比特币,凭借着“数字黄金”的叙事,巩固着价值存储的地位。

The current bitcoin is still the old bitcoin, consolidating its value storage position with the narrative of “digital gold”.

不过,现在的以太坊,就不再是以前的那个以太坊了。

But now it's not the same as it used to be.

以太坊摸索出了 DeFi 这条明路,不断搭建完善着生态体系中的金融乐高。现在,我们有了交易量流动性可媲美中心化交易所的 DEX,有了各式各样的借贷协议、合成资产协议、预言机系统衍生品交易平台、算法稳定币协议以及突然火爆起来并自主出圈的 NFTs……

We've got a lot of loan agreements, synthetic asset agreements, derivatives trading platforms for predictive systems, currency stabilization protocols, and & nbsp; NFTs...

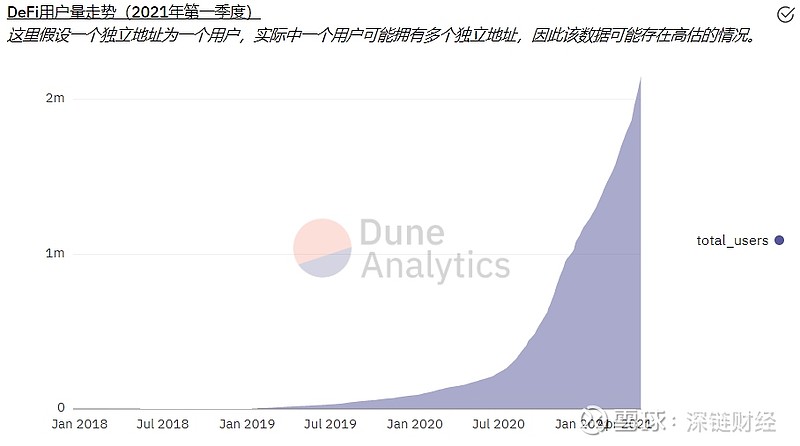

DeFi 用户量自2020年起突飞猛进,如今已经成功突破两百万用户。

The DeFi user count has increased dramatically since 2020 and has now succeeded in breaking over 2 million users.

DeFi 用户量突破 2 百万 | 来源:Dune Analytics

DeFi User Breakthrough & nbsp; 2 millions & nbsp; nbsp; Source: Dune Analytics

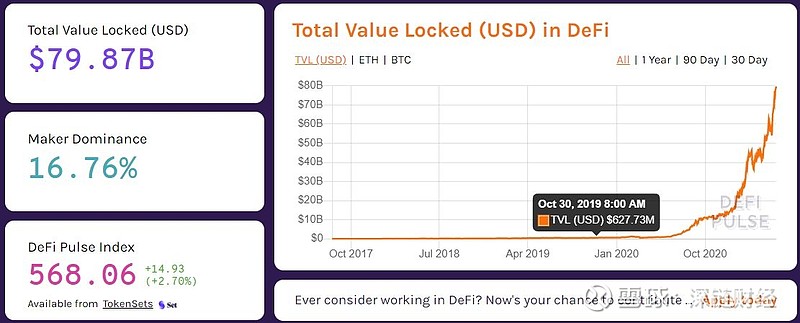

DeFi 总锁仓价值屡创新高,目前总锁仓价值约 800 亿美元。

DeFi has an innovative value, and the total value of the lockup is now around & nbsp; 800 & nbsp; and billions of dollars.

DeFi 总锁仓价值 | 来源:DeFi Pulse

DeFi Total Locker Value & nbsp; nbsp; Source: DeFi Pulse

尽管现在以太坊生态一片繁荣,但是我们知道,一切还早,以太坊的链上商业才刚刚开始,以太坊的全球金融经济体的愿景才刚刚起航,而作为这个庞大的商业经济体上的基础货币,将会有大量的使用需求,结合上文 ETH 总量有限甚至通缩的情况,这种供需关系势必在 ETH 价格上有所体现。

Despite the current boom in the Taipan ecology, we know that it is still too early to start business on the Taipan chain, that the vision of the global financial economy is just beginning to sail, and that, as the base currency for this large commercial economy, there will be a great demand for use, combined with the & nbsp above; the limited or even deflation of the ETH total, which will necessarily be reflected in the & nbsp; and the ETH prices.

Flippening is coming?

ETH/BTC市值占比 | 来源:blockchaincenter. Net

ETH/BTC market value ratio & nbsp; nbsp; source: blockchaincenter. Net

根据 blockchaincenter.net 的数据显示,截止撰稿时,以太坊的市值只有比特币市值的 37.6%,距离超越还有段距离。

According to data from & nbsp; blockchaincenter.net, at the time of writing, the market value of the tatais was 37.6 per cent of the value of Bitcoin was at a distance.

截止撰稿时, ETH-BTC 的汇率在 0.06 上下浮动,若以太坊市值想要超越比特币,汇率至少得上涨 169.22%,涨至 0.16153。

At the time of writing, the exchange rate of ETH-BTC was at 0.06 floated up and down and the exchange rate had to rise at least 169.22% up to 0.16153 if the market value of Taihu was to exceed Bitco.

不过从图中我们可以看出,历史上,以太坊市值最高曾占据比特币市值的 83%,那时候估计就是以太坊社区第一次喊出 Flippening 的口号,可惜未果。

However, as can be seen from the graphs, historically, the highest market value in the district was & nbsp, which used to occupy the market value of Bitcoin; 83 per cent, when it was estimated that it was the first time that the & nbsp; Fluppening had been called by the community, unfortunately, unsuccessfully.

虽然我们期待的是市值的一个超越,但是在超越未果之前,我们也可以来观察对比一下比特币vs以太坊的一些基本面指标:

While we look forward to a go beyond the market value, we can also look at some of the basic indicators that compare Bitcoinvs with Tails before we go beyond what has been achieved:

活跃地址数占比(以太坊 vs 比特币),当前占比约为 70%,尚未反超!

The percentage of active addresses (Etheria & nbsp; vs bitcoin) currently stands at about 70%, not exceeded!

总交易手续费占比 (以太坊 vs 比特币),自2020年下半年后,基本上都完成了大反超!

The total transaction fee ratio & nbsp; (Etheria & nbsp; vs Bitcoin) has been largely counterproductive since the second half of 2020!

那么,以太坊市值超越比特币 Flipening 有可能实现吗?

So, is it possible that the market value of Ethera beyond Bitcoin & nbsp; Flipning could be realized?

我认为 Flipening 早晚会发生!

I think it will happen sooner or later!

不加时间限制的预测不是耍流氓吗?

Isn't an open-ended forecast of hooliganism?

我认为本轮周期应该是很难实现超越,理想状态的话,能够在下轮周期中实现市值超越。不过这其中有几个关键因素:

I think this cycle should be difficult to achieve and, ideally, be able to achieve market value over the next cycle. But there are several key factors:

对于以太坊来说,要想实现永久性的超越,就目前的规划来看,绝对离不开EIP1559的引入以及 PoS 成功过渡。

For Etheria, the introduction of EIP1559 and the successful transition of & nbsp; PoS are absolutely essential to achieve a permanent transition in terms of current planning.

对于比特币来说,再经历2~3次减半后,作为保障网络安全的区块奖励跟整个网络价值相比已经不成正比,网络安全性是否能够得到有效保障也有待考究;若彼时ETH的价值存储属性已经成型,那么ETH或许会成为更为恰当的价值存储之选。毕竟如上文可知,在总交易手续费这一块,以太坊已经远远超越了比特币网络,而比特币网络的相关 L2 支付方案,目前尚未有实际的大规模落地应用。

For Bitcoin, after two to three more halves, it is no longer fair to compare the value of the network as a block incentive to secure the network with the value of the network as a whole; if the value-storage properties of the ETH are formed at the time of the other, the ETH may become a more appropriate value-storage option. After all, as is known above, in the area of total transaction fees, the Taipan has gone far beyond the Bitconet network, which is associated with & nbsp; L2& nbsp; and the payment scheme, which has not yet been applied on a substantial scale.

Flippening,以太坊市值超越比特币,是天方夜谭?还是高瞻远瞩?你怎么看呢!

Floppening, is it heaven and night, or is it vision? What do you think?

参考链接:

Links to reference:

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论