比特币(BTC)在最初是一文不值的,发展到目前为止成为了市值最高的加密货币,深受投资者的关注和喜爱,在2021年暴涨后,2022年受到了重挫,在进入2024年,比特币涨势比较明显,并且不断刷新了今年比价新高,到目前为止还是有很多投资者关心比特币在未来是否值得投资和关注,之后是会涨还是跌呢?接下来小编就带来详细的比特币(BTC)十年价格走势分析预测。

The development of Bitcoin (BTC), which was initially worthless, has so far become the most market-valued encrypted currency, and has been of interest and love to investors. After the 2021 surge, the year 2022 suffered a severe setback. In 2024, the price of Bitcoin rose more sharply and the price of this year was constantly updated. So far, many investors have been concerned about whether bitcoin is worth investing in and interested in the future, and then whether it will rise or fall.

比特币(BTC)是什么?

What's a bitcoin?

比特币(BTC)是一种去中心化的加密货币,采用点对点网络与共识主动性的技术实现,同时也是开放源代码的加密数字资产。

Bitcoin (BTC) is a decentralised encrypted currency that is realized using a point-to-point network and consensus initiative technology and is also an encrypted digital asset with open source codes.

比特币的创始人中本聪(网名)(Satoshi Nakamoto)于2008年10月31日发表了一篇论文,这启示了比特币的诞生,而第一个区块(创世区块)于2009年1月3日诞生。比特币的区块链技术,通过一种去中心化的、不可篡改的方式,将数据记录在一个区块链中,以保证其安全性和可追溯性。

Bitcoin’s founder, Satoshi Nakamoto, published a paper on 31 October 2008, which inspired the birth of Bitcoin, the first block (inventive block) which was born on 3 January 2009. Bitcoin’s block chain technology, in a decentralized and non-roguable way, records data in a block chain to ensure its safety and traceability.

对于比特币的追随者来说,它已经不仅是一种新形式的货币,而且是一项突破性的技术,它向世界介绍了去中心化货币的概念,并为一种全新的经济类型— —加密货币市场奠定了基础。对其他人来说,这是一种快速赚钱的方式,虽然其中一些早期投资者确实成功加入了比特币百万富翁的行列,但也有人在试图预测其价格走势时损失了数百甚至数千美元。

For the followers of Bitcoin, it has become not only a new form of currency, but also a breakthrough technology that has introduced the world to the concept of decentralized currency and laid the foundation for an entirely new economic type & mdash; & mdash; encrypted currency markets. For others, this is a quick way to make money, and while some of the early investors have indeed succeeded in joining the Bitcoin millionaire, others have lost hundreds or even thousands of dollars in trying to predict their price movements.

比特币最新新闻和动态

比特币现货ETF 于4 月30 日登陆香港,令市场感到兴奋,但比特币整体价格状况仍不稳定。在本周初价格低于62,000 美元的低点之后,比特币价格走势得到了一些健康的缓解,但比特币仍不能突破其关键位,目前正在重新测试潜在支撑位。

Bitcoin’s spot ETF landed in Hong Kong on April 30th, excites the market, but the price of bitcoin as a whole remains unstable. After a low price of less than $62,000 at the beginning of this week, Bitcoin’s price movement has been somewhat relaxed, but Bitcoin is still unable to reach its key position and is currently re-testing its potential support position.

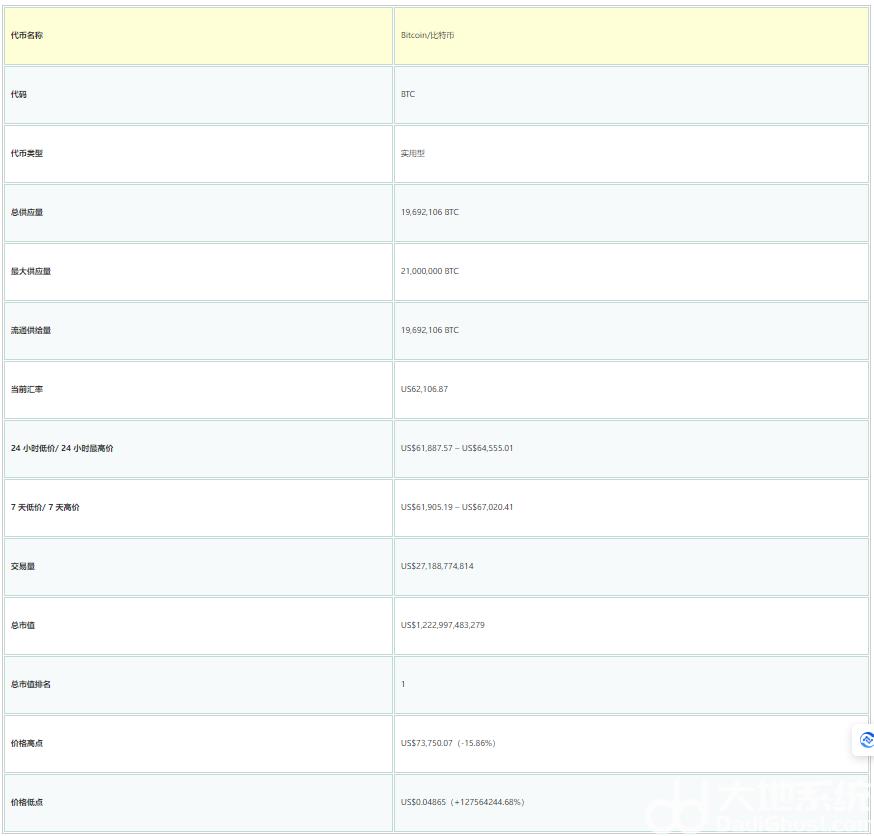

比特币(BTC)市场概述

(上述数据更新至2024/4/30)

(The above data are updated to 2024/4/30)

可以看到,截止4 月30 日,比特币距离历史最低价格涨幅高达 127564244%,而距离历史高点也仅一步之遥。

As can be seen, by 30 April, Bitcoin was only one step away from the lowest price increase in history, amounting to 1275,642.4 per cent.

比特币最初的价格是多少?

What was the initial price of Bitcoin?

比特币最初几乎一文不值。

Bitcoinwasn'tvalued at first.

首次赋予比特币货币价值的交易是在2009 年10 月,当时芬兰计算机科学专业的学生Martti Malmi(网名Sirius)以约159 台币的价格出售了5,050 个比特币,每个比特币的价值为0.0009美元。交易是在PayPal 上进行的。这可能令人难以置信,因为如今有如此多的加密货币交易所致力于买卖 比特币。

The first transaction of monetary value to Bitcoin took place in October 2009, when Martti Malmi, a student in computer science in Finland, sold 5,050 bitcoins at a price of about 159 pesos, each worth US$0.0009. The deal was done on PayPal. This may be incredible, because so many encrypted currency exchanges are now dealing in bitcoin.

从2013 年到2015 年开始,比特币开始受到关注。此后,比特币迅速上涨,从一美分的零头上涨到2021 年11 月接近68,789.63 美元的历史新高。

From 2013 to 2015, Bitcoin began to receive attention. Since then, bitcoin has risen rapidly, from zero cents to an all-time high of nearly $68,789.63 in November 2021.

不过,比特币价格的上涨并非一帆风顺的,以下将为您详细介绍比特币过去十年的价格走势。

However, the increase in the price of bitcoin has not been smooth, and you will find below a detailed account of the price trends of bitcoin over the past decade.

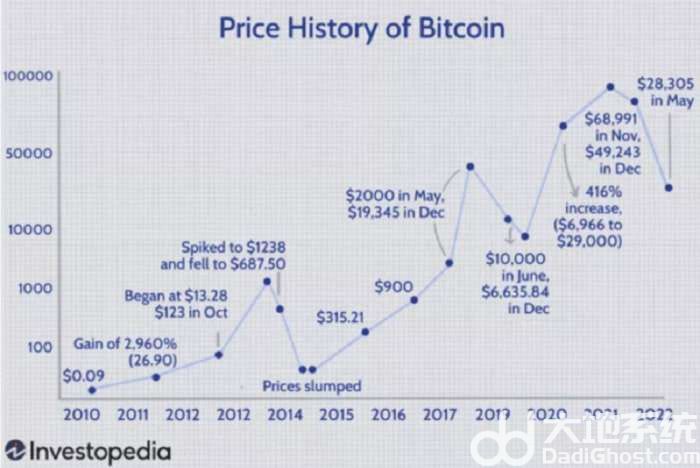

比特币十年历史价格走势

Bitcoin's 10-year historical price trends

BTC从诞生到现在已经超过了10年,当中其价格波动是几百万倍,多次被宣告崩盘,却多次恢复生机,而对于处在当下的我们都会有一个疑惑,现在BTC的价格对于未来来说还有多大的潜力。

The BTC, which has been in existence for more than 10 years now, has experienced price fluctuations of millions of times, has been declared crashes, but has recovered many times, and we will all be wondering how much BTC prices now have potential for the future.

很多新进场的韭菜或许并不知道比特币的历史,今天就带大家回顾一下比特币十年历史走势,并且详细说一下至2012年以来每次大行情是在什么环境下诞生的。

Many of the new arrivals may not know the history of Bitcoin, but today they take a look back at the 10-year history of Bitcoin and elaborate on the circumstances under which each of the big moves has taken place since 2012.

1、从诞生到有价值

1. From birth to value

2008全球金融危机爆发,在这一年11月比特币创始人中本聪发表了白皮书《一种点对点的电子现金系统》。 2009年1月3日,中本聪在芬兰使用小型服务器挖出了BTC的创世区块,同时得到了50枚BTC。早期参与比特币挖矿的大多是一些极客,因为这个时候BTC挖矿难度比较低,用普通的计算机就能参与,由于这个时候的比特币只是在极客的圈子中流通,因此BTC在当时几乎是没有价格的,大多数以赠送、奖励等方式流通。

On 3 January 2009, China discovered BTC’s creation block in Finland using a small server, while at the same time it received 50 BTCs. Most of the early participants in Bitcoin's mining were extremes, because BTC was less difficult to dig and could be involved with ordinary computers at this time, when Bitcoin was only circulating in the circle of extremes, and therefore BTC was almost unpriced at the time, most of them circulating through gifts, awards, etc.

2010年5月21日,一个美国的程序员用10000枚比特币换取了2个披萨,当时这两个披萨的市场价是30美元,折合下来1枚BTC的价格是0.003美元,这就是BTC第一次在现实世界中的定价。在这之后,引发了一波挖矿热潮,同年11月当时全球最大的交易平台Mt.Gox上BTC的价格突破了0.5美元,比购买披萨的价格上涨了167倍。

On 21 May 2010, an American programmer traded 10,000 bitcoins for two pizzas at a market price of $30, which was equivalent to a BTC price of $0.003, the first time that BTC had been in the real world. This triggered a boom in mining, with BTC prices on Mt.Gox, the world’s largest trading platform, breaking 0.5 dollars in November of the same year, a 167-fold increase over the price of pizza.

2012年,是BTC的第一个快速发展期,同时也是充满波折的一年。这一年,BTC与英镑、波兰等法币交易兑的交易平台上线,国内最早的交易平台比特币中国也于这一年诞生。其后《福布斯》等美国主流媒体报导了比特币的相关新闻,使得更多的投机者进场,到6月份BTC从2010年年底的0.5美元涨到了当时的最高价32美元,但随后不久Mt .Gox爆发了第一次骇客事件,一系列安全问题遭到了质疑,其后使得BTC价格快速回落,10月底和11月底两次触底2美元,这轮也可以说是BTC最开始的一个轮牛熊。

In 2012, the BTC’s first rapid period of development was also a year full of swings. This year, BTC’s trading platform with pounds sterling, Poland, and other French currency deals went online, and the country’s earliest trading platform, Bitcoin China, was born that year.

2、疯牛之后

Two, after the mad cow.

2012年下半年比特币基金会成立,同年11月BTC第一次挖矿产量减半,形成了BTC两个必要的爆发条件。 2013年1月塞浦路斯债务危机的爆发,不少人摒弃传统金融行业,与此同时由于比特币所灌输的「去中心化」总量恒定等标签,受到了人们的青睐,这也是比特币首次被燃起了避险资产的定义。

The establishment of the Bitcoin Foundation in the second half of 2012, the first time in November of the same year that BTC dug in half the amount of minerals, created two of the necessary conditions for BTC’s outbreak. The outbreak of the Cyprus debt crisis in January 2013 led many people to abandon the traditional financial sector, while at the same time it was favoured by the label “decentization” that Bitcoin had instilled, and that was the first time that Bitcoin was given a definition of risk-free assets.

由于上述的一系列因素,BTC从2013年1份的13美元,到4月10日上涨至260美元的高点,3个月上涨20倍。或者也是因为BTC短期内涨幅太快,在随后的3天时间里暴跌至46美元,跌幅达到了82%。其后开始了长达180天的震荡周期。直到2013年10月,欧洲各国出台比特币的相关政策,BTC开启疯狂模式,12月初涨到了这轮牛市的高点1163美元,超过了当时黄金的价格,这轮行情BTC从2012年初的低点2美元开始到2013年12月一共上涨了480倍。

As a result of a series of factors described above, BTC rose 20 times in three months, from 13 dollars in 1 in 2013 to a high of $260 on 10 April. Or because BTC grew too fast in the short term, falling sharply to $46 in the following three days, reaching 82%.

2014年2月25日全球最大的BTC交易平台Mt.Gox突然宣布破产,原因是其自有的10万枚BTC和用户的75万枚BTC被盗,这件事造成的影响实在太大了,市场持续低迷,BTC开启了长期的下跌趋势,市场持续低迷,2015年8月BTC跌至200美元,跌幅80%。至此牛熊转换宣告开始。

On 25 February 2014, Mt. Gox, the world's largest BTC trading platform, suddenly declared bankrupt because of the theft of its own 100,000 BTCs and 750,000 BTCs from its users, the effects of which were far too high, the continuing low market, the long-term downward trend of BTC, and the continuing low market, which fell by 80 per cent in August 2015 to $200.

3、区块链崛起

3. The rise of the block chain

2016年BTC第二次挖矿产量减半,之前第一次减半的预期使得BTC加速上涨,而第二次减半预期同样是BTC第二轮牛市的主要上涨因素。这一年国际上也不平静,英国脱欧、美国大选、亚洲投资者激增等一系列影响,BTC也至2015年10月开启缓慢上升。 2016年ETH的崛起,引起了大家对区块链概念的关注,把整个数字市场推向了大泡沫当中。而芝商所、芝期所上线BTC期货的预期,BTC再次开启疯狂上涨,在这期间即使在2017年9月份暴跌了50%,依旧阻止不了市场的热情,在2017年12月18日到达了19666美元,这两年BTC累计上涨了100倍。

In 2016, the rise of the ETH drew attention to the concept of block chains, pushing the entire digital market into a big bubble. And the expectation of BTC’s BTC’s primer, BTC’s frenzy, which began to rise again, even after a 50% drop in September 2017, did not stop the market’s enthusiasm, reaching US$ 19666, on 18 December 2017, and a cumulative 100-fold rise in BTC’s futures in both years.

物极必反是恒久不变的自然规律,当2017年投资者的热情达到顶点的时候,整个市场出现了一系列的负面新闻,爱惜欧开始各种爆雷,市场被泼了一盆冷水迅速降温,BTC进入了下跌趋势,反弹一次比一次弱,直至2018年年底触底3122美元。

When the enthusiasm of investors reached its peak in 2017, there was a series of negative news throughout the market, which began with a variety of thunderbolts, was quickly cooled by a wave of cold water, and the BTC entered a downward trend and rebounded weaker than once until the end of 2018, when it hit a bottom of $3122.

4、2019年复苏迹象

IV. Signs of recovery in 2019

这一年,国际上同样不太平静,BTC已经进入了机构投资者的视野,各大传统金融机构跑步进场、布局,逐渐获得主流机构的认同,随着美国科技巨头发布libar,在世界上又开始掀起一股区块链革命话题。再加上BTC在2020年5月产量减半的预期,整个基本面发生的变化,潜力不可同日而语,将会有更多的人认识到BTC的价值,影响力也会逐渐扩大。 2019年,BTC较年初上涨了3倍,不过数市场还没走出2018年熊市的阴影,目前并不算进入牛市,但也进入了牛熊转换窗口,未来随着一系列预期,BTC价格在2021年突破10万美元也是可以想像的。

In addition to the BTC’s expected reduction in production by half in May 2020, the potential for changes in the whole fundamentals will not be the same. More people will be aware of the BTC’s value and influence will grow.

5、2020年比特币爆发

5. Bitcoin outbreak in 2020

2020年是多事之秋,前有疫情,后有中美冲突,当下北约内部矛盾,一度激化上演全武行。全球经济萎靡,各国政策加剧了投资者的担忧,因此催化了比特币价格大爆发,比年初上涨了416%,更在2021年初打破了前一年的记录,最终创下68,991美元的历史新高。

The year 2020 was the fall of events, followed by an outbreak of conflict between China and the United States, and an all-embracing conflict within NATO at a time. The global economic downturn, with national policies exacerbating investors’ concerns, led to a dramatic surge in Bitcoin prices, which rose by 41% from the beginning of the year, breaking the record of the previous year at the beginning of 2021, culminating in an all-time high of $68,991.

6、2022年比特币受到黑天鹅事件影响

The Black Swan incident affected Bitcoin in June, 2022.

2022 年对于加密货币产业来说,确是一个充满灾难性的一年。价值达百亿美元的Terra、三箭资本和FTX 在几个月的时间内,相继倒下,投资者受到了极大的损失,使得整个产业感觉像是倒退了很多年。

2022 was a catastrophic year for the crypto-currency industry. Ten billion dollars worth of Terra, three arrow capital, and FTX fell over a few months, and investors suffered huge losses, making the whole industry feel like it's been going backwards for years.

尽管如此,2022 年却也给我们带来了一些积极的发展。以太坊终于完成了「合并」,虽然以太币的价格表现不佳,但今年的表现还是很不错。另外,一些国家在战争、受制裁、货币贬值、通膨高窜又经济停滞的背景下,也承认了加密货币的潜力。

Even so, the year 2022 brought some positive developments. Ether was finally able to “consolidate.”

2022 年,无疑是加密货币历史上最动荡的一年,但经历了这艰难的熊市,整个生态系统也得以幸免于难。无论是产业对于加密货币的承认,还是新的价值提案,2022 年的这场大洗牌都给了我们一个新的开始。

2022, undoubtedly the most turbulent year in the history of encrypt money, has survived this difficult bear market, and the entire ecosystem has been spared. Whether industry’s recognition of encrypt money or a new value proposal, this big shuffling in 2022 gave us a new start.

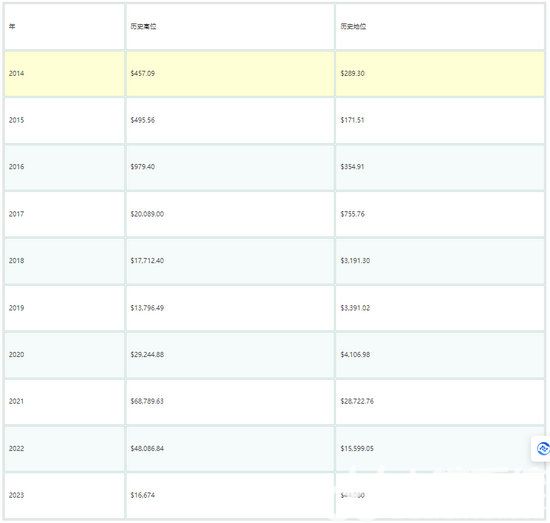

比特币十年价格历史记录(2014-2023)

从上述比特币走势分析可以看到,比特币的波动性尤其大。以下简单总结了过去十年比特币的最低价格和最高价格。

As can be seen from the above-mentioned Bitcoin trend analysis, bitcoins are particularly volatile. The following is a brief summary of the lowest and highest prices in bitcoins over the last decade.

影响比特币价格走势的因素

自2021年冲破最高点后,比特币价值一路下滑,全球经济瓶颈、通膨、战争和美元政策转变等不确定性,投资者担心加密行业的长期生存能力,价格开始波动更大。

After breaking the peak in 2021, the value of Bitcoin fell all the way, uncertainties such as global economic bottlenecks, inflation, war and policy shifts in the United States dollar, and investors feared the long-term viability of the encryption industry and prices began to fluctuate even more.

以下因素可能对比特币价值的影响大于平均货币或证券:

The following factors may affect the value of Bitcoin more than the average currency or securities:

1、稀缺性

1. Scarcity

与一个国家或经济体内的其他货币、产品或服务一样,比特币和其他加密货币的价格取决于感知价值和供需。

As with other currencies, products or services within a country or economy, the price of Bitcoins and other encrypted currencies depends on perceived values and supply and demand.

如果人们相信比特币具有特定的价值,他们就会购买它,特别是如果他们认为它会升值的话。

If people believed that Bitcoin had a particular value, they would buy it, especially if they thought it would appreciate it.

依照设计,比特币只会被创造2,100 万个。只要需求保持不变或增加,比特币越接近其极限,其价格就越高。

By design, Bitcoins would be created only 21 million. As long as demand remained constant or increased, the closer Bitcoins would be to their limits, the higher the price would be.

比特币是透过挖掘软体和硬体以指定的速率创建的。这个比率每四年减半,减慢了硬币的创造数量。

Bitcoin was created at a specified speed by digging soft and hard. This rate is reduced by half every four years, slowing the amount of coin creation.

只要比特币继续受欢迎并且其供应无法满足需求,其价格就应该继续上涨。然而,如果人气下降且需求下降,则供应量将大于需求量。那么,比特币的价格应该会下跌,除非它因其他原因保持其价值。

As long as Bitcoin continues to be popular and its supply fails to meet demand, its prices should continue to rise. However, if there is a decline in human morale and demand, the supply will be larger than demand.

2、投资者炒作和市场情绪

2. Investor production and market sentiment

影响比特币价格的另一个因素也与供需有关。目前,比特币已经成为投资者和金融机构用来储存价值和产生回报的金融工具。

Another factor affecting Bitcoin prices is also related to supply and demand. At present, Bitcoin has become a financial instrument used by investors and financial institutions to store value and generate returns.

而投机、投资产品炒作、非理性繁荣以及投资者的恐慌和恐惧也可能会影响比特币的价格,因为需求会随着投资者情绪的变化而上升和下降。

Speculation, speculation of investment products, irrational prosperity and investor panic and fear can also affect Bitcoin prices, as demand rises and falls as investor sentiment changes.

3、挖矿周期

3. Mining cycle

比特币挖矿也会影响比特币的价格。矿工是处理网路交易的强大计算机,它们是新铸造的比特币的来源。

Bitcoin digs can also affect bitcoin prices. Miners are powerful computers that handle Internet transactions, and they are the source of newly forged bitcoins.

由于矿工创造并累积新的货币,他们的整体行为可能会对市场价格产生很大的影响。矿工必须出售比特币来支付电费和维护费用。但他们选择如何处理剩余的硬币可能会影响价格。

As miners create and accumulate new currencies, their overall behaviour can have a significant impact on market prices. Miners have to sell bitcoins to pay for electricity and maintenance.

例如,当矿工预计比特币的未来价格将高于现在时,他们可以选择持有大部分比特币,从而减少交易所的整体供应量。这将为价格创造支撑。

For example, when miners expect the future price of bitcoin to be higher than it is now, they can choose to hold most bitcoin, thereby reducing the overall supply of the exchange. This will support prices.

另一方面,如果矿工认为比特币的价格将会下跌,或者他们今天由于某种原因需要现金,他们可以出售他们的比特币,增加供应并可能压低价格。

On the other hand, if miners believe that the price of bitcoin will fall, or if they need cash today for some reason, they can sell their bitcoin, increase supply and possibly lower prices.

4、大众接受度提高

4. Increased public acceptance

有人说比特币的真正价值在于比特币网路。换句话说,有多少人在使用比特币。

Some say the real value of Bitcoin is in bitcoin. In other words, how many people use bitcoin.

一个粗略的类比是社群媒体网路。我们倾向于透过用户数量以及他们在平台上的活跃程度来衡量社交网路的价值。 Facebook 和Instagram 均拥有超过10 亿用户,其中至少有一半用户每天都会登入Instagram。这是人们认为这些网路有价值的主要原因。

A rough analogy is social media networks. We tend to measure the value of social networks by the number of users and their level of activity on the platform. Facebook and Instagram have more than 1 billion users, at least half of whom log in every day.

随着比特币的发展,创建加密货币钱包、将法定货币转换为比特币并消费或储存这些货币的人越多,比特币就会变得越有价值。随着比特币价格的上涨,更多的人倾向于加入网络,可能形成正回馈循环。

As bitcoin develops, the more people create encrypted wallets, convert legal currencies into bitcoins, and consume or store them, the more valuable bitcoins become. As bitcoin prices rise, more people tend to join the network, which may create a positive feedback loop.

5、加密货币监管政策

5. Encryption money regulatory policy

各国对加密货币这种新兴资产类别的监管态度尚不明朗,政策参差不齐,任何新法规都有可能影响价值。

National regulatory approaches to new asset classes, such as cryptographic currencies, are unclear, policies are uneven and any new legislation may have an impact on value.

由于比特币是当前市值最大的加密货币,因此其价格将会对其他加密货币价格造成影响。然而,其他加密货币也可能影响比特币的价格。

Since Bitcoin is the most marketable encrypted currency today, its price will have an impact on the price of other encrypted currencies. However, other encrypted currencies may also affect the price of Bitcoin.

加密货币有多种,而且随着监管机构、机构和商家解决问题并采用它们作为可接受的支付和货币形式,其数量持续增加。

Encrypted currencies are diverse, and their number continues to increase as regulators, institutions and traders resolve problems and adopt them as acceptable forms of payment and currency.

最后,如果消费者和投资者相信其他代币将被证明比比特币更有价值,那么需求就会下降,价格也会随之下降。或者,如果情绪和交易朝相反方向发展,需求将随价格上涨。

Finally, if consumers and investors believe that other tokens will prove more valuable than bitcoins, demand will decline, and prices will decline. Or, if emotions and transactions move in the opposite direction, demand will rise.

2023 年比特币表现如何?

How's Bitcoin doing in 2023?

比特币在2023 年的表现取决于多种看涨和看跌因素。机构采用、监管变化、技术进步、宏观经济趋势等众多因素影响比特币市场的复杂动态。

Bitcoin’s performance in 2023 depends on a variety of viewing and downswing factors. A multitude of factors, such as institutional adoption, regulatory changes, technological advances, and macroeconomic trends, influence the complex dynamics of the Bitcoin market.

在看跌因素中,我们有一些值得注意的事件,涉及大量可能随时进入市场的比特币。 Sciberras 指出:「时隔近10 年,Mt Gox 债权人终于将在今年收到被盗的比特币(约138,000 BTC,约30 亿美元)。更多的抛售压力可能来自美国政府。它已开始出售3月查获的比特币,仍有价值(约)12 亿美元的比特币待出售。」

In view of the drop, we have some noteworthy events involving a large number of bitcoins that may be entering the market at any given time. Sciberas states: “In nearly 10 years, Mt Gox creditors will finally receive stolen bitcoins (about 138,000 BTC, about $3 billion) this year. More sales pressure may come from the US government. It has started selling bitcoins seized in March, and it still has a value of $1.2 billion bitcoins to sell.

这些事件可能导致比特币大量涌入市场,如果需求与供应突然增加不匹配,可能会对价格造成下行压力。

These events could lead to a massive influx of Bitcoin into the market and, if demand does not match the sudden increase in supply, could create downward pressure on prices.

正如2022 年所看到的那样,加密行业仍然存在一些薄弱环节,仍然可能导致进一步的灾难。争论的一个主要问题是美国商品期货公司目前针对CZ 和加密货币交易所Binance 提起的民事执法行动交易委员会(CFTC)。 「我们还必须承认更广泛的加密市场可能存在的风险。如果币安及其执行长受到指控,或者加密货币公司的倒闭或倒闭尚未结束,仍然存在潜在的下行催化剂。」Sciberras 表示。

As we saw in 2022, there are still some weaknesses in the encryption industry, which may still lead to further catastrophes. A major issue in the debate is the Civil Enforcement Operations Trading Commission (CFTC), which the US Commodity Futures Company is currently filing against CZ and the Encrypted Currency Exchange, Binance.

从看涨的角度来看,Sciberras 指出了比特币价格上涨的潜在催化剂:特斯拉恢复比特币支付。正如他所说,「执行长马斯克表示,一旦比特币达到50% 再生能源的比例,他将恢复比特币支付。这可能会引发一些积极的价格走势。” 考虑到马斯克的影响力和特斯拉在市场上的地位,此举确实可能引发新一波的兴趣和采用,可能会推高比特币的价格。

From an upswing perspective, Sciberras pointed out the potential catalyst for the price increase in bitcoin: Tesla's recovery of bitcoin payments. As he said, "Engineer Musk said that once bitcoins reach 50% of regenerative energy, they will return to bitcoins. This could trigger some positive price movements. Andrdquo; given the influence of Mask and Tesla's position in the market, this could indeed generate a new wave of interest and adoption, and could push bitcoin up prices.

利率上升的停止以及随后利率回归较低水平也将成为比特币的重要看涨催化剂。在这种情况下,像比特币这样的加密货币可以为投资者提供一个有吸引力的资金存放场所,因为它被认为可以对冲传统金融体系,而且随着2024 年减半的临近,其稀缺性也日益增加。

The cessation of interest rate hikes and the subsequent return to lower levels of interest rates will also be important catalysts for the growth of bitcoin. In this case, encrypted currencies like Bitcoin can provide investors with an attractive repository of funds, which is thought to be able to hedge the traditional financial system and which is becoming increasingly scarce as 2024 approaches.

如果比特币获得批准,贝莱德等机构对启动BTC ETF 的兴趣也是比特币的巨大潜在催化剂。目前,美国证券交易委员会(SEC) 正在等待近10 份申请,并且在做出决定之前只允许他们在有限的时间内提交申请。

If Bitcoin is approved, the interest of institutions like Belede in starting BTC ETF is also a huge potential catalyst for Bitcoin. Currently, the United States Securities and Exchange Commission (SEC) is waiting for nearly 10 applications and allows them to submit only for a limited period of time before a decision is taken.

多项申请的截止日期即将到来,因此投资者应密切注意任何消息。

The deadline for multiple applications was approaching, so investors should keep an eye on any information.

比特币未来走势分析及价格预测

Analysis of Future Trends and Price Forecasts for Bitcoins

目前来看,比特币已经失去了其历史最高价值的70%上述,指向底部并且至少接近数字资产。然后考虑到比特币多年来的表现以及看起来已经确立的趋势,它指向底部已经出现。

At present, Bitcoin has lost 70% of its historical highest value, pointing to the bottom and at least close to digital assets. Then, considering Bitcoin’s performance over the years and what appears to be a well-established trend, it points to the bottom.

如果这种趋势持续下去,那么从2023年到2025年,比特币的表现可能会再次跑赢大盘。此外,它将把下一个牛市的顶峰定在2024年至2025年之间,预计这些年数字资产至少会实现两位数的增长。

If this trend continues, between 2023 and 2025, Bitcoin’s performance is likely to win again. Moreover, it will set the next cattle market’s peak between 2024 and 2025, with digital assets expected to grow by at least two digits in those years.

专家曾预测比特币最快在2022年就能达到10万美元,经过2022年的黑天鹅,比特币几乎腰斩。

Experts had predicted that Bitcoin would reach $100,000 as soon as possible in 2022, and that after the 2022 black swan, bitcoin would be almost beheaded.

2023年BTC正显示出一些回稳迹象,不过尚未脱离险境,加密市场预计会与全球股市和经济发展,越来越靠齐。

The 2023 BTC is showing some signs of resilience, although it is not out of danger and the encryption market is expected to be increasingly aligned with global equity markets and economic development.

比特币每年的供应约增长2.5%,而需求增长速度更快! 2020年BTC减半后,新的BTC供应量减少,导致价格预测飙升至超过1万亿美元的市值。市场需求增加,会导致出现更剧烈的价格变化。

Bitcoin’s supply growth is about 2.5% per year, and demand is growing faster. After halving BTC’s supply in 2020, the new BTC’s supply declined, resulting in price forecasts soaring to more than $1 trillion in market value.

BloombergIntelligence预测2025年的比特币价格为100,000美元,因为大多数需求和采用率指标都支持BTC的上涨轨迹。 PlanB'sBitcoin的预测数据,同样支持BTC将升至十万美元的说法。然而,分析师PeterBrandt预测,比特币价格正在盘整,需要跌到13,000美元才能开始走高。根据我们的独家看法,BTC虚拟货币的价值似乎已准备好进一步下跌。

Bloomberg Intelligence predicts a price of $100,000 in 2025, because most demand and adoption indicators support the BTC’s upward trajectory. PlanB' sBitcoin’s projections, similarly supporting BTC’s claim that it will rise to $100,000. However, analyst Peter Brandt predicts that Bitcoin’s prices are being rounded up and need to fall to $13,000 to start rising.

目前比特币已逐渐渗透到主流市场中,经得起时间的考验,作为一种新兴资产和加密货币,投资者常用它来保值,对抗通膨和市场不确定性,如果大众能克服恐慌性抛售的想法,未来势必有更大规模的通行度,成为安全可靠的长期货币,上涨之势不难预见。

Now that bitcoin has gradually infiltrated the mainstream market and has stood the test of time, as an emerging asset and an encrypted currency, investors often use it to preserve their value against inflation and market uncertainty. If the general public can overcome the idea of panic selling, there will have to be a larger flow to become a safe and reliable long-term currency in the future, and the upward trend is not difficult to predict.

2024年比特币BTC最新价格预测

Recent BTC Price Forecast 2024

比特币以爆炸性的方式开启了新的一年,一月份的交易价格两年来首次突破45,000 美元,随后在2 月底该资产因对比特币现货ETF的持续需求而突破60,000 美元。

Bitcoin opened a new year in an explosive manner, with a trading price of $45,000 for the first time in two years in January, followed by an asset of $60,000 at the end of February owing to the continuing demand for the spot ETF in Bitcoin.

据估计,比特币现货ETF 是2024 年推动比特币和整个加密货币领域价格的两大主要催化剂之一,Glassnode预计约700 亿美元的新资本将透过新的比特币ETF进入加密货币市场。

It is estimated that the spot ETF of Bitcoin is one of the two major catalysts for prices in the area of Bitcoin and the entire area of encryption in 2024, and Glassnode expects that new capital of about $70 billion will enter the market through the new ETF of Bitcoin.

除了比特币ETF 的通过外,另一大催化剂是即将到来的比特币减半事件,一些分析师认为这可能有助于比特币今年突破六位数。

In addition to the passage of the Bitcoin ETF, another major catalyst is the upcoming halving of the bitcoin, which some analysts believe may help Bitcoin to break the six-digit mark this year.

在这一切发生的同时,开发人员正忙于推出比特币第2 层协议——以去年比特币铭文的出现和流行为基础——这也可能成为网路活动增加的催化剂,从而增加对比特币的需求。

At the same time, developers are busy rolling out the Bitcoin 2nd Tier & mdash; — &mdash based on the emergence and prevalence of last year's Bitcoin motto; and may also be a catalyst for increased online activity, thereby increasing the demand for bitcoin.

总的来说,2024 年初比特币ETF 的通过、比特币网路透过Layer 2 和铭文的实用性持续增长,以及即将到来的减半,为2024 年BTC 创造了非常积极的前景。

Overall, the passage of the Bitcoin ETF at the beginning of 2024, the continued growth in the usefulness of the Bitcoin Internet through Layer 2 and the inscriptions, and the upcoming halving of the number of BTCs, created very positive prospects for 2024.

根据我们的预测,在最佳的情况下,比特币价格将在2024 年突破85,000 美元,尽管也有一些分析师认为BTC 在此之前将出现重大调整。

According to our projections, in the best of circumstances, bitcoin prices will go over $85,000 in 2024, although there are also analysts who believe that BTC will undergo a major adjustment before that time.

而最糟糕的情况是,比特币可能会下跌并重新测试38,000 美元的支撑位。

And the worst case scenario is that bitcoin may fall and retest the 38,000 dollar support position.

2025 年比特币价格预测

比特币减半事件的影响将持续到2025 年,如果一切顺利,比特币有可能突破10 万美元的难以捉摸。但什么是「其他一切」?

The impact of the halving of Bitcoin will continue until 2025, and if everything goes well, bitcoin could break 100 million dollars. But what is "all other things"?

「其他一切」包括宏观经济因素的改善。如果全球经济表现良好且通膨保持较低水平,那么2023 年大幅上涨的利率可能会在2025 年进一步下降。对加密货币山寨币的更严格监管也可能导致越来越多的投资者有信心投资加密货币第一次,其中许多投资者可能想持有一些比特币。

If the global economy behaves well and inflation remains low, the sharp rise in interest rates in 2023 is likely to fall further in 2025. Rigorous regulation of the encrypt currency mountain currency may also lead to a growing number of investors confident that they will invest in the encrypt currency for the first time, many of whom may want to hold some bitcoins.

此外,对加密货币市场的更严格监管可能会导致机构基金(例如退休基金)将比特币添加到其投资组合中。这可能会释放目前不允许投资比特币的数万亿美元的退休基金。目前,富达是唯一提供直接比特币投资的美国401(k) 计画提供者。

Moreover, stricter regulation of the crypto-currency market may result in institutional funds (e.g., pension funds) adding bitcoins to their portfolios. This could release trillion-dollar pension funds that are not currently allowed to invest in bitcoins.

然而,比特币减半事件的影响通常会在事件发生后12 至18 个月内创下历史新高,这对比特币本已看似积极的2025 年来说是一个巨大的积极推动。

However, the impact of the halving of the Bitcoin event, which usually reached an all-time high within 12 to 18 months of the incident, was a significant positive impetus for the year 2025, when Bitcoin had already appeared to be positive.

综合所有这些因素,我们预测比特币将在2025 年达到50,000 美元的低点,以及100,000 美元的高点,因为它在回撤到10 万美元之前成功突破了10 万美元的巨大心理里程碑。我们也预计2025 年比特币的平均价格将达到65,000 美元。

Combining all these factors, we predict that bitcoin will reach a low of $50,000 in 2025, and a high of $100,000, because it has succeeded in breaking a huge psychological milestone of $100,000 before retreating to $100,000. We also expect the average price of bitcoin to reach $65,000 in 2025.

2030 年比特币价格预测

展望2030 年,我们的比特币价格预测变得不太确定。六年内可能会发生很多事情,特别是在像加密货币这样快速发展的行业。八年前,比特币的价格约为420 美元。

Looking ahead to 2030, our bitcoin price projections are becoming uncertain. A lot can happen in six years, especially in industries as fast as encryption money. Eight years ago, Bitcoin was about $420.

也就是说,我们预期比特币的价值将持续成长。它可以受益于中央银行数位货币(CBDC)的引入,这应该鼓励更广泛地向使用数位资产的支付过渡。

In other words, we expect the value of Bitcoin to grow. It could benefit from the introduction of the Central Bank's digital currency (CBDC), which should encourage a broader transition to the payment of digital assets.

到2030 年,比特币将在2028 年经历另一次减半事件,这将影响2030 年的价格预测以及比特币的可用性,特别是因为我们预计届时它们将变得越来越受欢迎。

By 2030, Bitcoin will experience another halving in 2028, which will affect price projections for 2030 and the availability of bitcoin, especially since we expect them to become increasingly popular by that time.

如上所述,由于强加货币的新颖性和不断变化的环境,很难预测比特币会发生什么。话虽如此,我们对2030 年比特币价格的预测预计价格将有所稳定,最低价为95,000 美元,最高价为160,000 美元,平均价格为127,000 美元。

As noted above, it is difficult to predict what will happen in bitcoin because of the newness and changing environment in which the currency is imposed. In spite of this, our projections for the price of bitcoin in 2030 are expected to be stable at a minimum price of $95,000, a maximum price of $160,000 and an average price of $127,000.

现在买比特币好吗?

Buy bitcoin now?

了解了比特币的历史价格和未来走势后,很多投资者最想知道的是,现在是买比特币的最佳时机吗?

Having learned about the historical price of bitcoin and future trends, what many investors want most is to know, is this the best time to buy bitcoin?

如果你对比特币有信心,想要长期持有,那么你可以在比特币回撤时,找到相对低点进场。

If Bitcoin is confident that you want to hold it for long, then you can find a relatively low entry when Bitcoin withdraws.

目前,大多数分析师对比特币未来的价格十分看好。

At present, most analysts look very well at the future prices of Bitcoin.

ARKInvest 分析师Yassine Elmandjra 表示,到2030 年,比特币的价格可能会达到100 万美元。这项分析基于以下观点:比特币仍然是一个不成熟的市场,将在未来几年实现许多新的用例。

ARKInvest analyst Yassine Elmandjra said that by 2030 the price of Bitcoin could reach $1 million. This analysis is based on the view that Bitcoin is still an immature market and will achieve many new examples in the coming years.

彭博资讯(Bloomberg Intelligence) 高级商品分析师Mike McGlone 向加密经纪公司Capital.com 表示,到2030 年,比特币可能会达到10 万美元。 McGlone 认为,需求增长与BTC 稀缺相结合将推高比特币价格。

According to Bloomberg Intelligence, a senior commodity analyst, Mike McGlone, told the encryption broker Capital.com that by 2030, Bitcoin could reach $100,000. McGlone argues that a combination of demand growth and BTC scarcity will push bitcoin prices up.

CoinShares(一家专门从事数位资产的欧洲另类资产管理公司)的研究主管预测,如果比特币ETF 在美国获得批准,到2025 年比特币的价格将达到141,000 美元。

CoinShares, a European alternative asset management company specializing in digital assets, predicted that by 2025 the price of Bitcoin would have been $141,000 had it been approved in the United States.

因此,比特币似乎是值得买入的。

Therefore, Bitcoin appears to be worth buying.

请记住,所有比特币预测都是预测。无法保证比特币会在任何时间范围内上涨,而且很难预测未来哪些全球经济事件会影响比特币的价格。

Remember, all bitcoin forecasts are forecasts. There is no guarantee that bitcoins will rise over any time frame, and it is difficult to predict which future global economic events will affect bitcoin prices.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论