EIP1559 部署一周,32000 ETH 被销毁,还有哪些数据值得关注? 8 月 5 日 20 点 34 分,以太坊网络区块高度达到 12,965,000,伦敦升级正式启动!这是一次备受以太坊社.

资讯 2024-06-23 阅读:100 评论:08 月 5 日 20 点 34 分,以太坊网络区块高度达到 12,965,000,伦敦升级正式启动!这是一次备受以太坊社区瞩目的升级,随着升级的顺利完成以及网络销毁的 ETH 数量不断飙升,以太坊社区欢声雀跃,V 神以及一些核心社区成员在 Youtube 直播间中也笑逐颜开,观看直播的粉丝都自觉亢奋地将「ETH TO THE MOON」打在了公屏上。

8 month & nbsp; 5 day & nbsp; 20 point & nbsp; 34 score, high & nbsp height in the Taiwan network block; 12,965,000, official launch in London! This is an upgrade to the attention of the community in the Tai Tao district & nbsp as the upgrade is successfully completed and the network is destroyed; the number of ETHs continues to rise and the number of ETHs rises, with V Gods and some members of the core community cheering in and Youtube live, where the fans watching the live air are self-aware to put "ETH TO THE MOON" on the public screen.

EIP1559 部署已顺利过去一周,现在或许是我们回顾这阶段,以太坊生态的各种数据基本面变化的好时机。

EIP1559 deployment has gone well over the past week, and it may be a good time for us to look back at this stage and change the basics of the various data of the Taiyan ecology.

「 EIP1559 部署后的数据洞察 」

1. 总销毁量 & 价值

截止 8 月 12 日 20 点 34 分,EIP1559 刚好部署一周整,在这一周里,以太坊网络共销毁约 32,000 ETH,价值约 1 亿美元。

End & nbsp; 8 & nbsp; month & nbsp; 12 & nbsp; day & nbsp; 20 & nbsp; point & nbsp; 34 & nbsp; point, EIP1559 & nbsp; just one full week of deployment during which approximately 32,000 & nbsp; ETH with a value of about & nbsp; 1 & nbsp; $ billion.

一周时间,销毁了如此惊人的数量/价值,也使得不少人看多 ETH。

The destruction of such an amazing quantity/value over a week has also made it possible to see a lot of people & nbsp; ETH.

不过需要知道的是,EIP1559 部署后,为了让以太坊区块容量保持 15M Gas,矿工需要把 Gas Limit 上调至 30M。由于升级完成后,依旧有部分矿工没及时调整该参数,所以会导致当时的 Gas 价格稍微偏高,销毁速度也会有所偏快,据了解,当时伦敦升级完成不到 6 个小时内,网络已经销毁近 2000 ETH。

But what you need to know is, EIP1559 after deployment, in order to keep the Ether block capacity 15M Gas, miners need to move Gas Limited up to 30M. As a result of the upgrade, some miners still fail to adjust the parameter in time, leading to the at the time; Gas prices are slightly higher and destruction speeds will be faster, as it is known that London was not upgraded to 6 the network has been destroyed near 2000 & nbsp; ETH within an hour.

2. 历史走势:ETH 销毁量、平均 Gas 价格、ETH 增发率

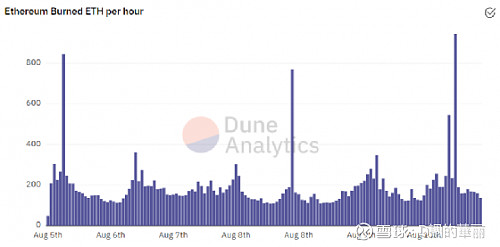

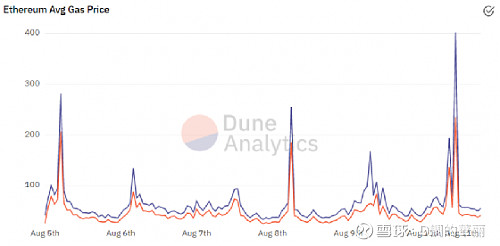

接下来,我们综合来看看,EIP1559 部署完成后的这一周里,以太坊网络的 「ETH 销毁走势」、「平均 Gas 价格走势」以及「 ETH 的增发率走势」。

Let's take a look at the following: EIP1559 the week after deployment, the & nbsp of EthioNet; "ETH destroys trends", "average & nbsp; Gas price trends" and "and & nbsp; ETH growth rates ".

ETH 销毁走势 | 来源:Dune Analytics

ETH Destruction Trends & nbsp; nbsp; Source: Dune Analytics

平均 Gas 价格走势 | 来源:Dune Analytics

Average & nbsp; Gas price trends & nbsp; nbsp; source: Dune Analytics

网络 ETH 的增发率走势 | 来源:Dune Analytics

Networks & nbsp; ETH growth and growth trends & nbsp; nbsp; source: Dune Analytics

综合上图,我们可以了解到,在这一周内,大体上:

In sum, we can see that during this week, in general:

? 网络基础费用(Base Fee)在 30~60 Gwei 区间震荡;平均 Gas 费用在 35~70 Gwei 区间震荡;结合可知,网络交易小费(Tip)在 5~10 Gwei 区间震荡。

♪ & nbsp; network base costs (Base Fee) in 30~60 Gwei Inter-Discussion; average Gas cost in 35~70 Gwei Inter-Discussion; combined, Tip in 5~10 Gwei Inter-Discussion.

? ETH 的平均销毁速度差不多为 150 ETH 每小时,即一天约为 3600 ETH。根据平均基础费用推导销毁数量的公式(x Gwei ? x*100 ETH/天),即平均基础费用约为 36 Gwei。

nbsp; ETH has an average destruction rate of approximately 150 ETH is about 3600 ETH. The formula (x Gwei? x*100 ETH/day) is derived from the average base cost, i.e. the average base cost is about 36 Gwei.

以太坊核心开发者、EIP-1559 联合作者 Eric Conner 此前表示,EIP-1559 将以太坊的年通货膨胀率从 4.2% 降低到 2.6%。值得一提的是,从 ETH 的增发走势图中,我们可以知道,在此前有三个瞬间,ETH 进入了通缩状态。

EIP-1559 , EIP-1559 co-author & nbsp; Eric Conner, previously indicated that EIP-1559 lowering to 2.6 per cent, it is worth mentioning that in the ETH's upward trend map, we can see that in three preceding moments, ETH is in a deflationary state.

当然,主要原因还是由于网络 Gas 价格的暴涨导致部分区块的区块奖励小于区块中销毁的基础手续费,而这种瞬时的 Gas 价格其实主要都是由于疯狂的 NFT 抢购导致的。

The main reason, of course, is that the price of some blocks is less than the basic fee for destruction in the blocks because of the network & nbsp; that the price of some blocks is higher than the price of the blocks & nbsp; that the price of Gas is, in fact, mainly due to the crazy & nbsp; and that the NFT buyout.

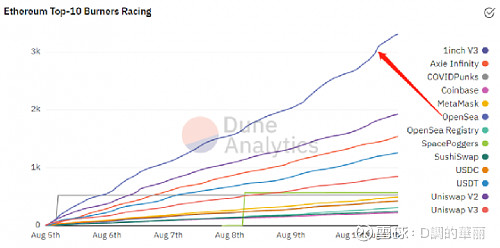

以 ETH 的增发率走势图中的第一个峰值为例,当时大概是 8 月 6 日凌晨 1 点左右,即 EIP1559 部署后 4 个小时内,以太坊网络的基础费用飙升至 207 Gwei,以传统手续费模式看来,Gas Price 飙升至 400 Gwei,而背后的始作俑者是由于 NFT 项目 COVIDPunks 的疯狂抢先铸造所推动的,而在单单一个小时内,COVIDPunks 项目所消耗的 Gas 费用已经排到以太坊网络的第一名,共花费了近 663 ETH。

The first peak in the ETH growth trend map was probably 8 month & nbsp; 6 morning 1 around point, i.e. EIP1559 after deployment; 4 & nbsp; & nbsp & & nbsp & & nbsp & & 207 & & & nbsp within an hour; Gwei, based on the traditional process fee model, Gas Price jumped to 400 & nbsp; Gwei, the beginning of which was due to & nbsp; NFT & nbsp; COVIDPunks & nbsp; & 66 & 66 & & tbsp; COVIDPunks project spent & n.

COVIDPunks 手续费消耗排名第一 | 来源:etherscan.io

COVIDPunks First & nbsp; nbsp; Source: elsescan.io

3. EIP1559 后,我们能期待的以太坊经济数据

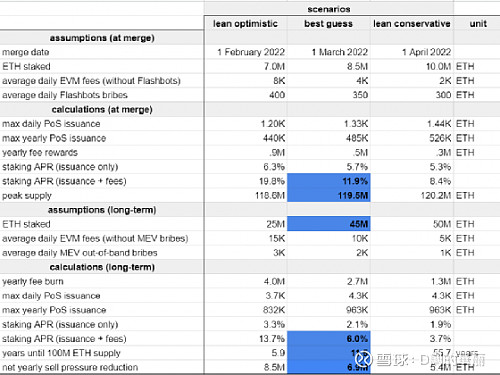

讲到 ETH 的通胀发行,这里不得不提及一下 8 月 8 日以太坊2.0研究员 Justin Drake 对 「 EIP1559 上线后以太坊的相关经济预测」:

With regard to the issue of inflation in ETH, mention must be made here of & nbsp; & nbsp; & nbsp; & nbsp; & japanta 2.0 Fellow; Justin Drake vs. & nbsp; EIP15559 and the relevant economic forecast in Taipane upon coming online:

Justin Drake 预测了 PoS 合并的三种可能时间点:乐观估计为 2022 年 2 月 1 日、可能性最高为 2022 年 3 月 1 日,保守估计为 2022 年 4 月 1 日。

Justin Drake predicted three possible points of time for PoS merger: optimistic estimates 2022 year & nbsp; month & nbsp; 1 day, maximum probability 2022 year & nbsp; 3 month & nbsp; 1& nbsp; day, conservative estimates 2022 year & nbsp; 4& nbsp; month & nbsp; 1& nbsp; day.

另外,结合 EIP1559 的手续费销毁以及 PoS 合并后的相关经济参数,Justin Drake 预测,理想状态下,未来 ETH 的供应上限可能为 1.2 亿,并且在 EIP1559 的销毁作用下,ETH 有望实现通缩,在 11 年内总供应缩减到 1 亿。并且在 PoS 发行以及手续费收入的综合下,参与 ETH2.0 质押的年化收益率区间有望为 8.4~19.8%。

In addition, combined with the destruction effects of EIP1559 process cost destruction and relevant economic parameters following the merger of PoS, Justin Drake predicts that future ETH supply caps may be 1.2 100 million, and EIP1559 ETH is expected to contract at 11 total supply reduction to 1 100 million; and & nbsp; & PoS issuance and fee income combined, participation in ETH 2.0 annualized return area of pledge is expected to be 8.4 - 19.8 per cent.

Justin Drake 对 EIP1559 上线后以太坊的相关经济预测

Justin Drake vs. & nbsp; EIP1559 & nbsp; relevant economic forecast for Tai-min when online

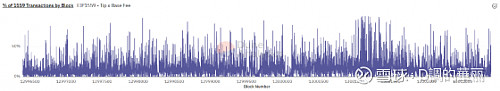

4. EIP1559 交易占比:交易不一定都是 EIP1559 手续费模式?

首先,我们要知道,完成伦敦升级后,以太坊主网仍然是向后兼容旧的交易格式的,旧的交易格式中的 Gas 价格会自动转化为「基础费用+小费」格式,Gas 价格支付完基础费用剩余的都将作为小费支付给矿工。(不管是不是需要这么多小费,所以旧模式所付的费用可能会偏高。)

First of all, we need to know that after the London upgrade, Ethernet is still back-to-back compatible with the old transaction format, in the old transaction format; Gas prices will automatically be converted into the "base fee plus tip" format, and the rest of Gas prices will be paid as a tip to miners. (Be it not so much tip, the costs of the old model may be high.)

通过上图我们可以知道,其实「 EIP1559 交易占比」这个指标的波动很大,但总体上,「 EIP1559 交易占比」集中在 5~20% 区间,特别是早期,占比基本上低于 5%,越往后占比总体才逐渐上升。

As we can see from the above figure, the indicator “ EIP1559 trade share” is highly volatile, but overall, “ EIP1559 trade share” is concentrated in 5~20% inter-districts, especially in the early years, are largely lower than and 5%, the overall share is gradually rising.

这个也不难理解,由于手续费向后兼容,部分钱包厂商尚未上线更新 EIP1559 手续费模式,随着后续更新的跟进,交易占比自然会逐渐提升。

It is not difficult to understand that some wallet manufacturers have not yet gone online to update EIP1559 and that the transaction ratio will increase as follow-up updates follow.

「 EIP1559 社区观点 」

对于这次 EIP1559 的部署,有喜闻乐见者,也有反对者。反对者中除了矿工这种直接利益相关者外,也有从经济理论出发的以太坊社区成员(这里以以太坊爱好者主理人阿剑老师为代表)。

In addition to direct stakeholders such as miners, there are also members of the Etheria community (represented here by the teacher of swords, the master of the taupules).

支持者的核心相关观点基本如下(基本上也就是 EIP1559 的好处):

The core relevant points of view of the proponents are basically the following (essentially the benefits of EIP1559 ):

? 优化用户体验:实现以太坊网络交易手续费的稳定性以及可预测性。

#nbsp; Optimizing User Experience: Achieving Stability and Predictability of Ethernet transaction fees.

? 基础手续费的设计能够解决「经济抽象」问题:以前交易手续费为零或者手续费不是以ETH代币的形式,矿工也可以进行打包(会以其他形式贿赂补偿矿工);但是现在的 EIP1559 手续费模式,交易必须包含基础手续费。

♪ & nbsp; Basic fees can be designed to solve the problem of "economic abstraction": previously transaction fees were zero or fees were not in the form of ETH tokens, and miners could also pack (other forms of bribes would compensate miners); but now EIP1559 and the fee model, the transaction must include basic fees.

? 完善 ETH 代币经济模型:以前 ETH 只是作为效用代币,在以太坊生态中充当手续费的作用,即使由于其基础货币的地位,也能间接捕获一些货币溢价,但无法直接捕获以太坊生态发展的价值;但是现在销毁基础手续费的设计就能完善这一缺陷,生态越繁荣将销毁越多 ETH 手续费,形成良性循环,完成 ETH 代币的价值捕获。

♪ & nbsp; Refinement & nbsp; ETH Economic Model: Formerly ETH merely as a useful token, acting as a service charge in the Taiyu ecology, even if it is in its position as a base currency that indirectly captures some of the currency premium, but not directly captures the value of EWE eco-development; but now the destruction base fee is designed to perfect this flaw, and the more the ecological boom will destroy & nbsp; ETH process fees, forming a virtuous circle, completing & nbsp; ETH demerits.

? 总而言之,就是销毁 ETH 能够减少流通量,利好 ETH 持有者,所以社区基本上都十分支持。

♪ nbsp; in short, destruction & nbsp; ETH can reduce circulation and benefit & nbsp; ETH holder, so the community is basically supportive.

而反对者的核心相关观点基本如下:

The core and relevant points of view of the opponents are essentially as follows:

? 剥夺矿工获得基础费用的本质是一种强制税收,不符合基本的经济学原理,是一种长期的隐患。

#nbsp; Denying miners access to basic costs is in essence a compulsory tax, inconsistent with basic economic principles and a long-term risk.

? EIP-1559 实际上并不能实现其愿景目标,反而会给系统引入不必要的属性。

? & nbsp; EIP-1559 does not actually achieve its vision, but introduces unnecessary attributes into the system.

存在正反两种观点其实是一件值得庆幸的事,这样可以避免我们过于盲目。当然,对于 EIP1559,社区大部分人都是支持的,特别是现在 EIP1559 已经部署,那么我们至少得了解反对者的论点论据,在实践中观察提醒,毕竟这一切也都是实验,没人敢保证 100% 成功。

The existence of both views is a good thing, so we can avoid being too blind. Of course, for EIP1559, most people in the community support it, especially now EIP1559 deployed, we need at least to understand the arguments of the opponents, and in practice we observe that, after all, they are experiments and no one dares to guarantee 100% success.

「 近期以太坊生态洞察 」

1. NFT + GameFi 主导网络

1. & nbsp; NFT + & nbsp; GameFi lead network

随着以 Axie Infinity 为代表的 NFT 链游的火爆,NFT 交易市场再次活跃,数据基本面再创历史新高,在 NFT + GameFi 热潮的推动下,以太坊生态摆脱了之前的“熊市氛围”。

With the & nbsp; Axie Infinity & & nbsp; the fire of the NFT chain, the NFT trading market was again active and the data base was once again at an all-time high in NFT + & nbsp; and the GameFi hot tide, the Taiwan ecology was pushed away from the former “bear city atmosphere”.

在币价方面,截止笔者撰稿时,ETH 从前期低点 $1700 一路上涨至 $3200 附近,涨幅接近一倍。在每日约 3600 ETH 销毁的兴奋剂助推下,市场对后市行情再次乐观。

In terms of currency prices, at the time of writing, ETH pre-period lows & nbsp; $1,700 & nbsp; all the way up to & nbsp; $3200 & nbsp; nearby, nearly doubles the increase. With the help of about 3600 & nbsp; ETH destroyed stimulants, the market is again optimistic about the rear market.

由于现在 NFT 交易市场 OpenSea 基本是 NFT 交易的主战场(7 月份市场份额占有率高达 96.3% ),所以对于 NFT 市场的火爆,我们可以从 OpenSea 近期的数据基本面中窥得一二。

Because now NFT Trade Market & nbsp; OpenSea is basically NFT Trading Main Fields (7 monthly market share as high as 96.3% ) we can look at NFT Market Expense from OpenSea Recent Data Basics.

在 7 月份, OpenSea 的月交易量超过 3 亿美元,月 NFT 出售数量超过 45 万,月手续费收入超过 2 千万美元,这三项数据指标都是过去单月平均数据结果的两倍以上。

In 7 OpenSea with more monthly transactions than 3 US$ billion, NFT with more than 45 0.000, with more than 2 and tens of millions of US dollars, these three data indicators are more than twice the results of the previous single-month average.

在 8 月份,截止 8 月 11 日,OpenSea 的成交量已经超过 7 月份的总成交量的两倍,在这 11 天里,OpenSea 的活跃用户已经远超 7 月份的总活跃用户,超过 8 万活跃用户。目前 OpenSea 交易市场的总交易用户量已突破 20 万。

In 8 month end month 11 day, OpenSea's turnover exceeded 7 month's total turnover is twice as high as in 11 day, OpenSea's active users are far more than 7 month total active users are greater than 8 10,000 active users.

OpenSea 月成交量 | 来源:Dune Analytics

OpenSea monthly transaction & nbsp; nbsp; source: Dune Analytics

在 EIP1559 部署后,以太坊网络中的 ETH 销毁贡献排行榜中,OpeaSea 基本也稳排第一。

& nbsp; EIP1559 After deployment, OpeaSea was ranked first in the & nbsp; ETH destruction contribution list.

2. 期权看涨 & 交易情绪升温

在伦敦升级前夕,ETH 未平仓期权持有量以及交易量明显上升,另外绝大多数 ETH 期权交易为看涨期权,而且这种看涨情绪不是 EIP1559 推动的短期投机看涨。

On the eve of the London upgrade, there was a marked increase in the share of the ETH unsettled options and in the volume of transactions, as well as in the vast majority of the & nbsp; the ETH options trading as interest increases, which were not & nbsp; EIP1559 and the short-term speculation promoted.

根据 Deribit 数据,8 月 6 日,到期日为次年 3 月 25 日的以太坊看涨期权成交量飙升,达 27,870 张,名义价值为$77,702,396.1。其中数量最多的到期日为次年 3 月 25 日的看涨期权行权价为 $50000 和 $40000,分别成交了 12,764 张和 12,509 张。

According to Deribit data, 8 6 date of expiry; 3 25 on & 27,870 & $77,702,396.1, nominal value. The largest number of due dates are 3 25 & $5000 & nbsp; and & nbsp; $40000, respectively & nbsp; 12,764& nbsp; & & nbsp; 12,509& nbsp; &.

根据 Alternative 数据显示,近一个月市场也逐步走出了恐慌情绪区间,当前已经处于贪婪情绪区间。

According to Alternative data, the market has also moved out of the panic zone in the last month and is now in a state of greed.

市场贪婪恐慌情绪走势 | 来源:alternative.me

Market greed and panic trends & nbsp; nbsp; source: alternative.me

3. EIP1559,助攻以太坊超越比特币?

今年 ETH 各方面的优越表现,更是强化了「以太坊超越比特币」的叙事。

This year & nbsp; ETH's superiority in all its aspects reinforced the narrative of "The Etherm over Bitcoin."

当前比特币的年通胀率约为 1.8%,而以太坊当前的通胀率已降低至 2.6% 左右,未来 PoS 实施后,更有可能实现供应上限,甚至通缩。而且在以太坊如此强势的生态加成下,以太坊超越比特币在一些人看来似乎不再是天方夜谭。

The current annual inflation rate in Bitcoin is about 1.8%, while the current inflation rate in Taipan has fallen to 2.6% around, the future and PoS is more likely to achieve supply ceilings or even deflation. And, with the eco-economy so strong in Etaipan, it seems to some that it is no longer the best way to move beyond Bitcoin.

不过,截至撰稿时, ETH-BTC 的汇率在 0.07 上下浮动,若以太坊市值想要超越比特币,汇率至少得上涨 129%,涨至 0.16045,菠萝V1V2+V Cris4119。

However, at the time of writing, the exchange rate of ETH-BTC was at 0.07 it was floating up and down, and if the market value of Taihu was to exceed Bitcoin, the exchange rate would have to rise at least 129 per cent, to and 0.16045, pineapple V1V2+V Cris4119.

「 结语 」

EIP1559 已经部署,在 ETH 持续销毁以及以太坊生态繁荣的情况下,熬至过渡到 PoS 合并,以太坊超越比特币的故事真的会成真吗?

EIP1559 deployed, with & nbsp; ETH continuing destruction and Ether's ecological boom, to make the transition to PoS merging, is it true that Ether's story overbitcoin will come true?

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论