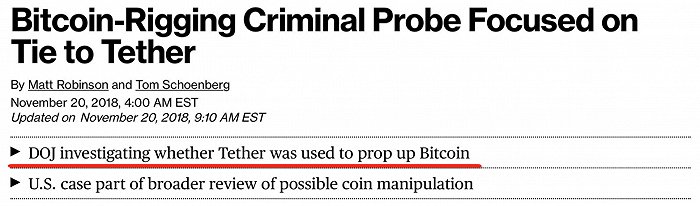

据彭博社报道,美国司法部正在对稳定币USDT开展调查,质疑其参与操纵比特币价格,导致2017年比特币暴涨。目前,比特币已击穿3500美元,但在去年年末曾飙升至2万美元。

According to Bloomberg, the U.S. Department of Justice is investigating the stabilization of the currency USDT, questioning its involvement in the manipulation of Bitcoin prices, which led to a sharp increase in bitcoin in 2017. At present, Bitcoin has hit $3,500, but it jumped to $20,000 at the end of last year.

在稳定币市场拥有绝对市场占有率USDT已几度面临信任危机,前不久,USDT在两小时内暴跌8%,其作为稳定币的地位遭到质疑。舆论指出的疑问包括,其一、背后锚定的美元资产或名不副实;其二、用户权益保护确实,没有实质性的合同文件承诺等价兑换1美元;其三、或通过超发USDT操控比特币市场价格。

The USDT’s position as a stable currency has been called into question a few times since it faced a crisis of confidence in the stable currency market’s absolute market rate of USDT, which fell by 8% in two hours. Public opinion has pointed to questions about, inter alia, its anchored dollar assets or its name; its protection of users’ rights and interests is true; it does not have a substantive contract document that promises to equalize the dollar; and its manipulation of Bitcoin market prices through over-distribution of USDT.

USDT实质是一种非金融机构的存托凭证,Tether公司承诺随时可将1USDT兑付为1美元,或者反向兑付。此前,Deltec银行和信托公司出具相关资产证明,称Tether有超18.3亿美元的储备金,有兑付能力。但直至11月中旬,仍有网友反映USDT兑付提现延迟的问题,USDT尚处争议之中。

In essence, USDT is a deposit voucher for non-financial institutions, and Tether is committed to paying 1 USDT to $1 at any time, or in reverse. Previously, Deltec Bank and Trust issued a certificate of assets stating that Tether had reserves of over $1.83 billion and was capable of making payments.

在交易所流通,但不会暴涨暴跌,稳定币成为虚拟货币市场的交易媒介、价值储藏、以及记账单位,也被投资者当作避险工具。由于USDT或从神坛跌落,稳定代币不再一家独大,逐渐形成相对良性的竞争。

As a result of the fall of the USDT or from the altar of God, stabilizing the currency is no longer unique and becoming relatively benignly competitive.

10月,中国人民银行数字货币研究所所长姚前及业务研究部主任孙浩在《中国金融》撰文指出,稳定代币分为基于法币抵押的稳定代币,代表产品有USDT、TrueUSD等,还包括基于数字资产抵押的稳定代币,如Dai,以及无抵押的稳定代币,如“算法央行”(algorithmic central banking)。

In October, the Director-General of the Digital Monetary Institute of the People's Bank of China, Yao, and the Director-General of the Department of Business Studies, Sun Ho, wrote in “China Finance” that stable tokens are divided into stable tokens based on French currency mortgages, representing products such as USDT, TrueUSD, etc., and also include stable tokens based on digital asset mortgages, such as Dai and “ arithmetical central bank & rdquao; algorithmic central banking.

USDT长期占据稳定币市场90%以上的份额,而目前其市场份额下降18个点,一度跌至70%左右。根据CoinMarketCap统计数据,TrueUSD的市场占有率上升,目前是市场份额第二的稳定代币。

While USDT has long held more than 90% of the stable currency market, its market share has now fallen by 18 points, once to about 70%. According to CoinMarketCap, TrueUSD’s market share has risen and is now the second stable currency in market share.

公开资料显示,TrueUSD,即TUSD,定期提供审计报告,且锚定的美元资产由信托公司托管,或对应解决了USDT存在争议的问题。近日,蓝鲸财经采访TrueUSD发行方TrustToken的联合创始人Stephen Kade,就稳定币市场的状况以及TrueUSD的运行模式等问题,询问TUSD方面的见解。

Public sources indicate that TrueUSD, or TUSD, regularly provides audit reports, and that anchored United States dollar assets are held by trust companies, or address disputed issues of the USDT. In recent days, Blue Whale Finance interviewed Stephen Kade, a co-founder of TrueUSD issuer, TrueUSD, to ask about the TUSD perspective on stabilizing the currency market and the mode of operation of TrueUSD.

USDT的信任危机由来已久,一年前已被诟病却并未造成严重影响,仍长期雄踞稳定币市场。Stephen Kade对此分析称,USDT拥有最多的币币交易对,且上线了众多交易所,对投资者而言有其便利性,投资者通常是在转账时暂时性地使用USDT,但由于信任缺失,投资者并不会长期持有USDT。

The USDT’s crisis of trust, which has been long-standing, has not been seriously affected a year ago, and has been a long-term source of instability in the currency market. Stephen Kade analyses it as having the largest number of currency transactions and the number of online exchanges, which are convenient for investors, who usually use the USDT on a temporary basis at the time of the transfer, but because of a lack of trust, investors do not hold the USDT for long.

USDT用户逐渐流失到TUSD等其他稳定货币,从市场份额看,TUSD目前是首选。对于目前TUSD取得的成绩,Stephen Kade介绍称,由于TUSD每月公布审计报告,其透明性和流通性较佳,在对稳定币的需求旺盛的时期,吸引了基金等场内场外体量较大的机构成为TUSD的第一批用户。同时,他透露,TUSD交易量的70至80%发生在亚洲,包括中国大陆、中国香港及新加坡等地。

USDT users are gradually losing to other stable currencies, such as TUSD, which is currently the preferred market share. Stephen Kade describes the achievements of the current TUSD as being more transparent and mobile, as a result of the monthly publication of audit reports by TUSD, which attracted the Fund’s most in-house and off-the-shelf institutions to become the first users of TUSD at a time when demand for a stable currency was strong. At the same time, he revealed that 70 to 80% of TUSD transactions took place in Asia, including mainland China, Hong Kong, China, and Singapore.

同为锚定美元的稳定币,他强调了TUSD与USDT的不同,USDT用户需先把资金打到Tether的账户里,再由Tether公司将客户的资金转移到托管账户里。TUSD客户是直接将钱转移到托管账户的,TUSD方面不经手客户的资金,没有权限从银行取走客户存款。此外,用户在出售TUSD时,可直接在其官网兑换成美金,“虽然最终USDT也会被兑换成美元,但是因为它的渠道并非官方兑换渠道,所以会产生信任危机。”

In the same vein, he highlighted the difference between TUSD and USDT, where USDT users had to transfer their funds to Tether's account before Tether transferred their clients' funds to a trust account. TUSD clients transferred their money directly to a trust account, and TUSD clients' funds were not authorized to withdraw their clients' deposits from banks. In addition, when selling TUSD, users could convert them directly into United States dollars on their official network, “ while eventually USDT would be converted into dollars, it would create a crisis of trust because its channels were not official exchange channels.

他表示,假如有一天,TUSD不幸“死亡”,投资人可直接找到托管公司,取回属于自己的美金,投资人不用担心项目方(TUSD)会发生什么危机。

He said that if one day the TUSD unfortunate & ldquao; the death & rdquao; and the investor could directly find the hosting company and recover his own dollar, the investor would not have to worry about the crisis that would arise for the project party (TUSD).

相比于其他层出不穷的稳定币,Stephen Kade谈到,TUSD已通过美国财政部下设机构金融犯罪执法局(“FinCEN”)注册为货币服务业务(Money Services Business,“MSB”),该牌照适用于多个州,GUSD和PAX尚且仅得到纽约州政府的批准。他还提到,TUSD是完全独立的,不与第三方挂钩,海外媒体曾报道,USDT发行方Tether公司和Bitfinex交易所管理团队重合,交易所有通过USDT操纵币价的嫌疑,目前热门的PAX、GUSD还有USDC旗下或母公司旗下都关联交易所,而TUSD不偏向任何交易所

Compared to the rest of the steady currency, Stephen Kade said that TUSD had been registered as a money service business (Money Services Business, & ldquo; MSB&rdquo) through the Financial Crimes Enforcement Bureau, an agency under the U.S. Treasury Department (“ FinCEN”) and that the licence plates applied to several states, GUSD and PAX were still approved only by the New York state government. He also mentioned that TUSD was completely independent and not linked to third parties, and that overseas media had reported that the USDT issuer, Tether, and Bitfinex Exchange management teams were reconnected, that all transactions were suspected of currency-fixing through the USDT, and that the hot PAX, GUSD, and the USDCs were currently linked to an exchange, while TUSD were not biased towards any exchange.

5月,TUSD上线币安时曾出现剧烈的价格波动,Stephen Kade对此现象回应称,最初上线币安时,TUSD市值在2000万到3000万美金之间,在自由市场上容易受到供需波动的影响,目前已达到1.6亿美金且在稳定增长,市值基数越大,TUSD的价格越不会被撼动。他提出,TUSD已经可以确保不会在再发生类似情况。

Stephen Kade responded to the sharp price fluctuations that occurred in May when TUSD was on the line, stating that when TUSD was initially on the line, its market value was between $20 million and $30 million, that it was vulnerable to fluctuations in supply and demand in the free market, that it now stands at $160 million and is growing steadily, and that the bigger the market value base, the greater the price of TUSD will not be shaken. He suggested that TUSD could already ensure that similar situations do not occur again.

据介绍,TUSD上线了50多家交易所,超过100对交易对,市场占比一度达到27%。从CoinMarketCap数据来看,TUSD目前的市值达到1.8亿美元,在币安的交易量占比最大。Stephen Kade认为出现这样的情况,其一是TUSD在币安上线较早,交易对也较多,同时也因为币安本身占有较大的市场份额。

According to the report, TUSD is on-line in more than 50 exchanges, with more than 100 pairs of transactions, with a market share of 27 per cent at a time. According to CoinMarketCap, TUSD currently has a market value of $180 million, with the largest volume of transactions in the currency.

公开资料显示,与TUSD合作的Prime Trust也是IBM联合推出的稳定币Stronghold USD的托管机构。关于TUSD合作的两家托管机构Prime Trust和Alliance Trust,Stephen Kade介绍了促成合作的原因,主要因为这两家机构本身较早入场加密货币市场,已有相应对接加密货币公司的经验,因此促成合作花费的时间及技术成本较低。同时,这两家都是有着比较长发展历史的财务管理机构。

According to public sources, Prime Trust, which works with TUSD, is also the custodian of Stronghold USD, a stable currency jointly launched by IBM. The two trustees for TUSD cooperation, Prime Trust and Alliance Trust, Stephen Kade, described the reasons for the collaboration, mainly because the two agencies themselves had earlier access to the encrypted currency market and had experience of matching the corresponding encrypted money companies, thus making the collaboration less time-consuming and technically costly.

据悉,TUSD已累计发布17份第三方独立报告,最近一次公开于10月31日,托管账户持有174,880,199.01美金。

According to the information received, TUSD has issued a cumulative total of 17 independent third-party reports, the most recent of which was released on 31 October, holding a trust account in the amount of $174,880,199.01.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论