近期比特币价格不断创造新高,在于27日突破13000美元后,价格出现回调,最后在11000美元左右逐渐稳定。

has recently been creating a new high in bitcoin prices, which have been rewinded since the break of $13,000 on 27, and have stabilized at around $11,000.

从大的市场趋势看,比特币在半年的时间里拉升了4倍,稳稳占据了市场的主导地位,在比特币出现上涨趋势时,不少交易者和加密货币爱好者对山寨币的现状表现出疑惑,甚至是焦虑情绪。

, in view of the large market trends, bitcoin increased fourfold in six months, steadily dominated the market, and during the upward trend in bitcoin, a number of traders and cryptophones expressed doubts and even anxiety about the status quo.

(来源:coinmarketcap)

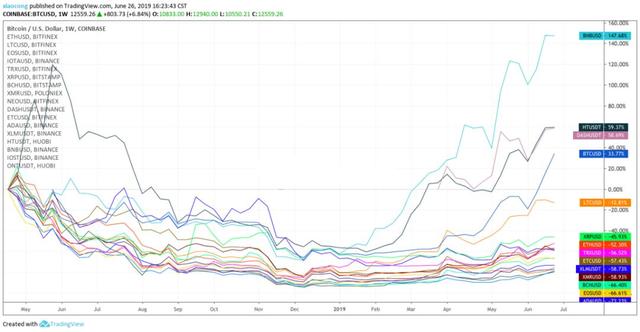

根据tradingview的数据显示,今年以来,加密市场上除了BNB、HT平台币涨幅较多以外,大部分的山寨币、竞争币都未能在涨幅上跑赢比特币,在牛市的这个阶段背后,一个问题浮现出来——为什么这一轮行情中,大部分主流山寨跑不过比特币?

, according to the data from the tradeview, since this year, with the exception of the BNB, the HT platform, most of the crypto markets have not been able to win bitcoins, and behind this phase of the bull market, a problem has emerged - why has most of the mainstream barons been able to run bitcoins in this round?

(来源:tradingview)

机构投资者入场

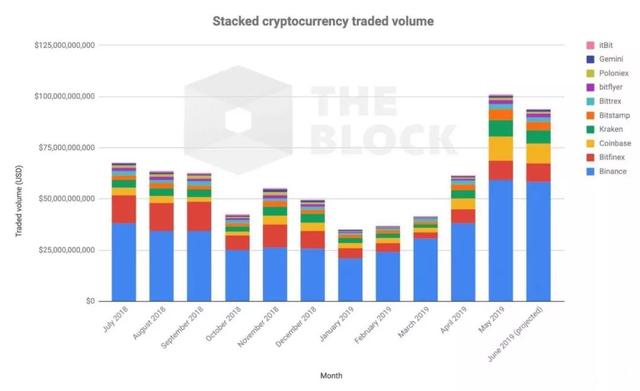

实际上,与2017年牛市相比,今年的行情波动不同寻常。通过TheBlock的数据表明,二级交易市场的成交量变化不大,比特币女博士的微博中也指出,影响比特币价格变化的关键点已不再是散户投资者了。对于这次的比特币价格的暴涨,究竟是什么因素在影响加密市场呢?不少的媒体机构也进行了分析。

actually, this year's volatility is unusual compared to the 2017 cattle market. Data from TheBlock show little change in the turnover of the secondary trading market, and Dr. Bitcoin's microblogging also suggests that the key to the price changes in bitcoin is no longer the investor in the diaspora. What is the factor influencing the price hike in bitcoin this time?

(来源:TheBlock 2018.7至2019.6.27交易所的交易成交量)

6月22日的《华尔街日报》文章也对于此次的牛市做出了分析,表明目前的交易机构对加密货币和的支持力度正在加大,机构投资者以及基金数量都已超过2017年,他们正在成为加密市场的主要参与者。

The Wall Street Journal article of 22 June also analysed the cattle market, indicating that the current trading agencies are increasing their support for encrypted money and funds, and that they are becoming major players in the encryption market in more than 2017.

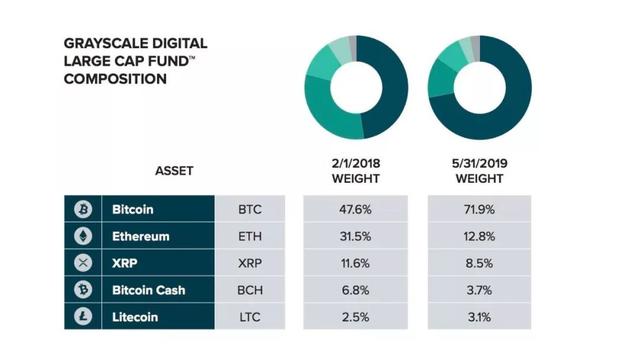

相对于媒体的报道分析,一些投资机构的真实数据更能证明事实。灰度投资由于其详细数据常被评为评估机构投资比特币的最佳指数,在6月份灰度的投资报告中透露,其比特币基金占比已从2018年的47.6%增加到今年5月底的71.9%,而其他的加密资产信托基金的投资额占比也明显下降。

除此之外,市场中比特币每月的开采量为5.4万枚,而灰度在今年4月份购买超过1.1万枚BTC,可以发现,灰度购买比特币的数量占全球供应量的21%左右。毫无疑问,这也透露出灰度正全力支持比特币,这对比特币的价格产生重要影响。

, in addition to the 54,000 bitcoins per month mined in the market, and the greyscale buys more than 11,000 BTCs in April of this year, it can be found that the greyscale buys about 21% of the global supply of bitcoins. There is no doubt that this also reveals that bitcoins are being fully supported by greyscale, which has an important impact on bitcoins prices.

目前多重数据表明,比特币这一行情的根本原因在于机构投资者,而非散户的增量资金。而山寨币的目前情况,也与其本身的问题存在密不可分的关系。

Current multiple data show that the root cause of the business of Bitcoin is the incremental capital of institutional investors, not the slobs. The current situation is also inextricably linked to its own problems.

山寨币的危机

即时身处牛市,山寨币自身的问题也难以掩盖,至于为什么会难于超越比特币,主要包含以下的的几个问题。

is in the bull market right now, and the problem of the bounties themselves is difficult to cover, so why it is difficult to go beyond bitcoin and consist mainly of the following questions.

1.2018年熊市危机

1.2018 Bear City Crisis

2018年作为熊市危机年,不少加密数字货币未能幸免于难,而山寨币更是损失惨重。据记录加密货币项目活跃情况的coinopsy网站统计,有264种山寨币未能存活下来,其中55%的项目是通过ICO在2017年推出的,不少项目借ICO模式行欺诈之事,可说那段时间里代投盛行,欺诈事件多发。ICO一夜暴富的神话不断吸引着投资者的涌入,但高危害也让投资者付出了惨痛代价。

2018, as the year of the Bear City crisis, a number of encrypted digital currencies were not spared, and the mountain coins were much lost. Coinopsy, which recorded the activity of the crypto-money project, counted 264 bounties that had not survived, 55% of which had been introduced by the ICO in 2017, and many of which had been fraudulently carried out under the ICO model, could be said to have been prevalent during that period, with a high incidence of fraud. The ICO myths of night-to-night wealth have attracted investors, but high hazards have also cost investors a terrible price.

2.难以落地

一个项目好坏,具体要看其具体落地的可能性。山寨币大多是对现有的项目进行模仿,却没有创新的币种。想要实现项目的落地,需要大量的资金和技术支持,以及多年的时间进行系统调试与维护,大多数的项目都难以实现应用的落地。甚至还有不少项目方只是想骗取不受监管的资金,仅靠发布“白皮书”,对项目的落地等信息一概而过。

is a project that is good and bad, depending on the likelihood of its specific landing. Most of the coins are imitated by existing projects, but there are no innovative currencies. It takes a lot of financial and technical support to achieve their landing, as well as years of systematic validation and maintenance, and most of the projects are difficult to achieve.

3.监管力度的加大

3. Increased regulation

此前,美国证券交易委员会(SEC)对山寨币的监管力度加大,一个月内三家大型数字货币交易所对美国用户做出限制,币安、火币、Bitfinex等交易平台主动退出美国市场。美国交易所Bittrex下架32种代币,其中不乏Factom、QTUM和STORJ这些较知名的项目,可能也是想在监管来临之前主动与这些“危险项目”保持距离。但随着各国的监管力度的加强,山寨币也成为交易所的巨大隐患,不少交易所已经不愿意再上线山寨币了。

was preceded by increased regulation by the United States Securities and Exchange Commission (SEC), three large digital money exchanges restricting United States users within a month, and trading platforms such as currency security, currency coins, Bitfinex, etc. voluntarily withdrew from the United States market. The US Exchange Bittrex has set up 32 sub-demonstrates, among which the more well-known projects of Factom, QTUM, and STORJ may also be seeking to distance themselves from these “dangerous projects” before the time of regulation.

总结

随着牛市的来袭,机构投资者们都早早的入场了,BTC的价格也在不断上涨,随着散户的FOMO情绪的爆发,散户可能不太敢参与BTC投资,反而选择市场上的山寨币,但山寨币所存在一系列的问题在警醒着我们,对于已经踏空这波比特币行情的投资者来说,还是要谨慎投资。

, institutional investors come early with the bull market, BTC prices rise, and, with the break-up of the diaspora's FOMO mood, the silos may be less likely to be involved in BTC investments than to choose the market's bounties, but the chain of problems with the bogus is a wake-up call, and for investors who have emptied the Bobitco, it is still prudent to invest.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论