6月18日下午,比特币一度跌破19000美元/枚,续刷2020年12月以来新低。过去7天内比特币跌幅达到33%,以太坊下跌36%,币安币(BNB)下跌27%。

In the afternoon of 18 June, Bitcoin fell by $19,000, continuing its decline since December 2020. Bitcoin fell by 33 per cent in the last seven days, with a 36 per cent drop in Ethio and a 27 per cent fall in BNB.

继5月中旬稳定币UST和其姊妹代币Luna出现危机之后,作为拥有170万用户的加密货币借贷巨头Celsius也身处危险边缘。本周一,Celsius宣称,因“极端市场条件”,该公司将暂停账户之间的所有提款、互换和转账。

Following the crisis in mid-May between the stabilization of the UST and its sister-in-law, Luna, Celsius, an encrypt money-lending giant with 1.7 million users, is also on the verge of danger. On Monday, Celsius claims that the company will suspend all withdrawals, swaps, and transfers between accounts due to “extreme market conditions.”

市场担心,作为Celsius股东的全球最大稳定币发行商Tether Limited会被拖下水,或将引发币圈的“雷曼危机”。

The market fears that Tether Limited, the world's largest stable currency issuer as a shareholder in Celsius, will be dragged into the water or will trigger a “Rayman crisis” in the currency ring.

全球虚拟币抛售潮持续!比特币7天内下跌33%

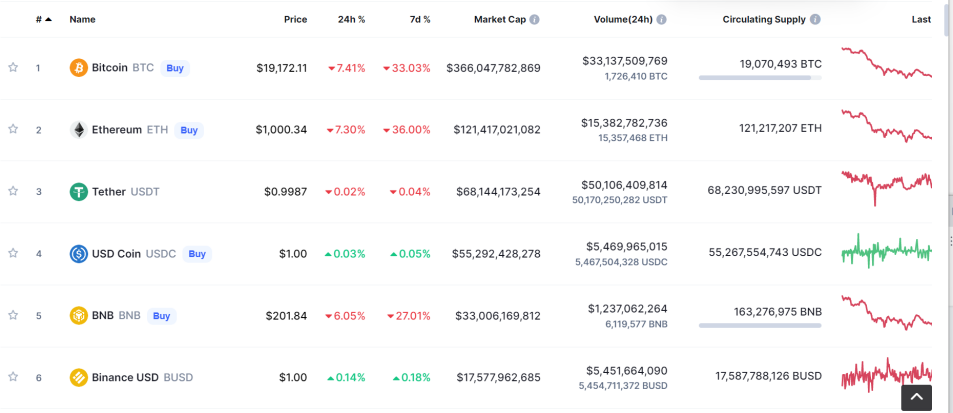

6月18日下午4时许,比特币跌破19000美元/枚,续刷2020年12月以来新低。截至6月18日晚9点,比特币价格约为19171美元,24小时跌幅达到7.41%,过去7天跌幅达到33%。

On 18 June, at around 4 p.m., Bitcoin fell by $19,000, continuing its decline since December 2020. By 9 p.m. on 18 June, the price of Bitcoin was approximately $19171, with a 24-hour drop of 7.41 per cent and a 33 per cent decline over the past seven days.

自2021年11月创下69000美元/枚的历史巅峰以来,比特币已贬值约70%。

Since the historic peak of $69,000 in November 2021, Bitcoin has been devalued by about 70 per cent.

第二大加密货币以太币也日内暴跌7.3%至1000美元,为2021年1月以来的最低水平。距此前最高位下跌近80%。

The second largest encrypt currency also fell by 7.3 to 1000 dollars per day, the lowest level since January 2021. Nearly 80% below its previous peak. & nbsp;

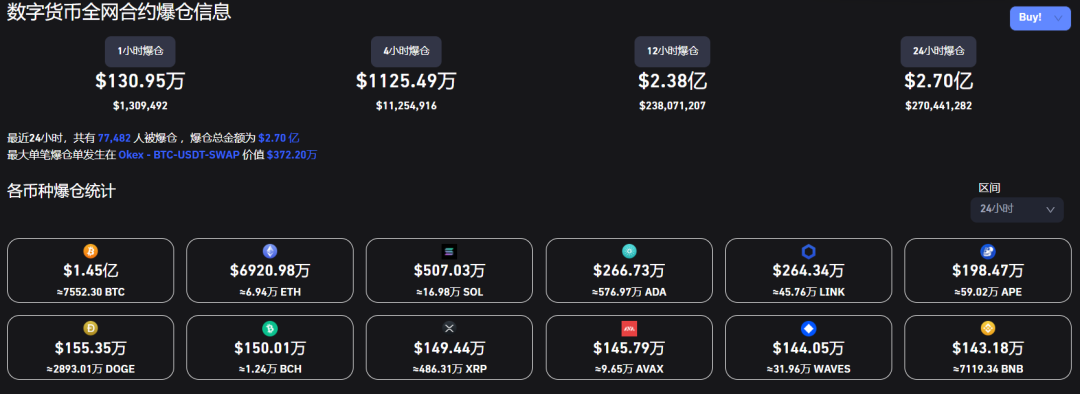

另据Coinglass数据,截至6月18日23时,数字货币领域共有7.7万人在过去24小时内被爆仓,爆仓总金额为2.7亿美元。

Also according to Coinglass data, as at 2300 hours on 18 June, a total of 77,000 people in the digital currency area had been detonated in the last 24 hours, with a total of $270 million.

BitMEX前首席执行官Arthur Hayes此前表示,20000美元和1000美元分别代表了比特币和以太坊的价格支撑位,如果被突破,将引发“巨大的抛售压力”。另外,比特币交易所Swan的比特币分析师Sam Callahan也认为,根据之前熊市的经验,比特币可能会从历史高点下跌80%以上。这意味着比特币将跌至13800美元。

The former Chief Executive Officer of BitMEX, Arthur Hayes, had previously stated that US$ 20,000 and US$ 1,000, respectively, represented Bitcoin and the price support of the Taiku, and that a breakthrough would trigger a “big selling pressure.” In addition, Sam Callahan, a Bitcoin analyst for the Bitcoin Exchange, Swan, argued that, based on the experience of Bear City, Bitcoin could fall by more than 80 per cent from historical heights.

据CNN报道,有分析师表示,跌破20000美元关口,对于在疫情期间蓬勃发展的市场来说,将是一个清醒的里程碑。外汇公司Oanda的高级市场分析师克雷格·厄拉姆(Craig Erlam)周二在一份报告中表示:“跌破20000美元将是巨大的心理打击,并可能使比特币进一步下跌。”

According to CNN, analysts report that breaking down the $200 threshold would be a sobering milestone for a market that flourished during the epidemic. On Tuesday, Craig Erlam, a senior market analyst for foreign exchange company Oanda, said in a report: “Breaking the $20,000 would be a huge psychological blow and could cause Bitcoin to fall further.”

相比其他资产,虚拟货币的熊市格外残酷。根据CoinMarketCap数据,去年11月,整个加密货币市场11月总市值为3万亿美元,而现在的总市值约为8440亿美元,短短7个月的时间“蒸发”掉了2.16万亿美元,缩水超70%。

Virtual currency bears are more brutal than other assets. According to CoinMarketCap, the total market value of the entire encrypted currency market was $3 trillion in November last year, while the total market value is now approximately $844 billion, with $2.16 trillion “evaporated” in just seven months, and more than 70 per cent shrinking.

值得一提的是,以比特币为首的虚拟货币价格不断跳水,也让不少币圈投资者很受伤。与2021年初花费15亿美元购买比特币相比,特斯拉投资损失已近6亿多美元。曾经的“华人首富”的币安交易所创始人赵长鹏在半年左右时间内损失了856亿美元,约合5770亿元人民币,跌幅达到九成。

Tesla’s investment losses are nearly $600 million, compared to the $1.5 billion spent on purchasing bitcoins at the beginning of 2021. Zhao Chang-peng, the founder of the once “Chinese-rich” currency exchange, lost $85.6 billion in about six months, amounting to approximately RMB 57.7 billion, a decline of 90%.

币圈“雷曼危机”拉开序幕?

"The Lehman Crisis"?

为何以比特币为代表的虚拟货币近期集体被投资者抛售?

Why is the virtual currency, represented by bitcoin, recently sold collectively by investors?

从宏观来看,随着世界主要央行提高利率以控制通胀,交易员纷纷抛售风险更高的投资,其中包括波动性较大的加密资产。更重要的原因或许是,本周一些投资者无法从部分加密货币交易所提取资金,加剧了投资者对于虚拟货币流动性的担忧。

At the macro level, as the world’s leading central banks raise interest rates to control inflation, traders sell higher-risk investments, including more volatile encrypted assets. Perhaps the more important reason is that some investors are unable to draw funds from some of the encrypted currency exchanges this week, increasing investors’ concerns about virtual currency liquidity.

周一,全球最大的加密货币交易所Binance周一暂停了几个小时的比特币提款,称一些交易“卡住了”导致挤压。

On Monday, Binance, the world's largest encrypted currency exchange, suspended a few hours of bitcoin withdrawals on Monday, claiming that some transactions were “cuffed” and resulted in crowding.

此外,拥有170万用户的加密货币借贷巨头Celsius也在周一宣称,因“极端市场条件”,该公司将暂停账户之间的所有提款、互换和转账。Celsius告诉其170万客户,已决定“在我们采取措施保护资产的同时,稳定流动性和运营。”Celsius没有说明何时重新开放交易所,该行表示,在允许客户再次提取存款之前,“需要一段时间”。

In addition, Celsius, an encrypt currency-lending giant of 1.7 million users, declared on Monday that it would suspend all withdrawals, swaps and transfers between accounts because of “extreme market conditions”. Celsius told its 1.7 million clients that it had decided “to stabilize liquidity and operations while we take steps to protect assets.” Celsius did not state when the exchange would be reopened, stating that it would “take some time” before allowing customers to make further deposits.

公司官网显示,截至5月17日,该公司拥有价值118亿美元的资产。市场分析认为,虽然相较于去年10月的260多亿美元明显下降,但从规模上来看Celsius依然被投资者视为“币圈银行”。

The company’s network of officials showed that, as of 17 May, the company owned $11.8 billion worth of assets. Market analysis suggests that, while there has been a marked decline from over $26 billion in October last year, Celsius is still, on a scale, regarded by investors as “banks in currency circles”.

据媒体报道,Celsius在业内地位不容小觑,号称拥有170万客户,并向用户宣传通过该平台他们可以获得18%的收益率。用户在Celsius存入他们的加密货币,然后这些加密货币被借给机构和其他投资者,然后用户从Celsius赚取的收入中获得收益。更重要的是,按照Celsius首席执行官Alex Mashinsky的说法,他们几乎参与了所有主要“去中心化金融(DeFi)”协议。

According to media reports, Celsius is in no small position within the industry, claiming 1.7 million clients and informing users of the 18% rate of return through the platform. Users deposit their encrypted currency in Celsius, then lend it to institutions and other investors, and then the user gains from the income earned by Celsius. More importantly, according to Celsius CEO Alex Mashinsky, they are involved in almost all major “deFi” agreements.

这意味着,继5月中旬稳定币UST和其姊妹代币Luna出现危机之后,作为币圈银行业成员的Celsius也已经身处危险边缘。一些投资者担忧道:如果这样的大型币圈银行都不能重新开放并允许提款,那么整个加密货币市场都将出现连锁反应。

This means that, following the crisis in mid-May between the UST and its sister-in-law Luna, Celsius, a member of the currency-banking industry, is on the brink of danger. Some investors are concerned that if such large currency-banking banks are unable to reopen and allow withdrawals, there will be a chain reaction to the entire encrypted currency market.

而市场更为关注的是,作为Celsius股东的Tether Limited——全球最大稳定币Tether的发行商,是否会被拖下水。如果把Celsius危机比作币圈的“贝尔斯登事件”,那么Tether Limited则是币圈雷曼级别的存在。

And the market is more concerned about whether the issuer of the largest stable currency in the world, Tether, is being dragged into the water. If the Celsius crisis is compared to the “Belfesdon” in the currency circle, then Tether Limited has a Lehman-level presence in the ring.

Tether Limited是价值1800亿美元的稳定币领域最大的运营商,在促进整个加密货币市场的交易方面发挥着关键作用,还提供了与主流金融系统的联系,相当于币圈金融基础设施。所谓“稳定币”是一种市场价值与美元或黄金等“稳定的”储备资产挂钩的加密货币,在加密货币市场承担定价锚和交易媒介的功能。

Tether Limited, the largest player in the $180 billion stable currency sector, plays a key role in facilitating transactions in the entire crypto-currency market, and also provides links to the mainstream financial system, equivalent to the financial infrastructure of the currency ring. The so-called “stabilized currency” is an encrypted currency whose market value is tied to “stable” reserve assets, such as the United States dollar or gold, and assumes the function of a price anchor and a trading medium in the crypto-currency market.

长期以来,Tether一直是业内受到最多审查的公司之一,目前它正面临来自监管机构、投资者、经济学家和越来越多怀疑论者的压力。人们担心,Tether如果出现问题,可能会引发多米诺骨牌效应,导致更大的崩盘。

For a long time, Tether has been one of the most censored companies in the industry, and it is now under pressure from regulators, investors, economists, and a growing number of skeptics. There is concern that Tether, if problematic, could trigger a domino effect, leading to a larger collapse.

美国大学金融专家希拉里·艾伦(HilaryAllen)表示:“Tether真的是加密生态系统的命脉。如果它内爆,会导致整面墙倒塌。”

U.S. University finance expert Hilary Allen says, "Teth is really the lifeblood of an encrypted ecosystem. If it explodes, it will cause the entire wall to collapse."

币圈寒冬

{\bord0\shad0\alphaH3D}The {\bord0\shad0\alphaH3D}The {\bord0\shad0\alphaH3D}The {\bord0\shad0\alphaH3D}The {\bord0\shad0\alphaH3D}The {\bord0\shad0\alphaH3D}The {\bord0\shad0\alphaH3D}The {\bord0\shad0\alphaH3D}

今年以来,币圈“雷声阵阵”,持续上演超级风暴。

Since the beginning of the year, the currency circle, the “things of thunder” has continued to play a superstorm.

今年5月12日,一度被币圈玩家称为“币圈茅台”的LUNA币狂泻逾99%,这一最高曾达119.5美元的加密货币,在当天跌至不足3美分,数百亿美元财富几近归零。

On 12 May of this year, over 99 per cent of LUNA coins, once referred to by currency-circumstance players as “the bottom of the currency ring”, fell to less than three cents on the same day, and tens of billions of dollars of wealth were close to zero.

根据CNN的报道,虚拟货币行业正在裁员以度过“寒冬”。

According to CNN, the virtual currency industry is being laid off to survive the “winter”.

美国最大的加密货币交易所Coinbase周二表示,将裁员约1000人,占员工总数的18%。理由是担心即将到来的经济衰退和“加密寒冬”。其最新的财报显示,2022年一季度净亏损达4.3亿美元,而前一季度的净利润为8.4亿美元。自去年4月在纳斯达克上市以来,该公司的股票受到重创。曾经它的最高市值近1000亿美元,现在仅不到120亿美元。

On Tuesday, the largest encrypted currency exchange in the United States, Coinbase, said that about 1,000 people, or 18% of the total workforce, would be laid off. The reason was fear of an impending recession and “encrypted winter.” Its latest financial report showed a net loss of $430 million in the first quarter of 2022, compared to $840 million in net profits in the previous quarter.

实际上,多家同行都在近几周宣布了大规模裁员,包括加密货币借贷平台BlockFi、加密货币交易平台Crypto.com、Gemini、总部位于阿根廷的交易所Buenbit。其中,Buenbit在5月份解雇了45%的员工。

Indeed, a number of colleagues have announced large-scale layoffs in recent weeks, including the encrypted money lending platform BlockFi, the encrypted currency trading platform Crypto.com, Gemini, and the Argentine-based exchange Buenbit, in which Buenbit fired 45 per cent of its employees in May.

不过,根据外媒报道,截至目前,各位币圈的大佬们对于币圈的暴跌并不太担心。他们说,这是理所当然的,加密技术的熊市与股票的熊市不同:低点更极端,但高点也更极端。

However, according to the foreign media, to date, the big players in the currency circles have not been very worried about the collapse of the currency circles. They say that it is natural that the bear market of encryption technology is different from the bear market of the stock: the lower, but the higher.

“加密货币的熊市通常会下跌85%至90%。”加密货币研究平台Blockworks的联合创始人杰森·亚诺维茨(Jason Yanowitz)表示。他还表示,在过去十年中,比特币经历了两次漫长的加密衰退,损失了80%以上的价值,但比特币也一次次反弹。

“The city of an encrypted currency usually falls by 85 to 90%.” Jason Yanowitz, the co-founder of the encrypted money research platform Blockworks, said. He also said that Bitcoin had experienced two long encryption recessions over the past decade, losing more than 80% of its value, but that Bitcoin had rebounded again.

2017年至2018年加密熊市期间,比特币暴跌83%,从19423美元跌至3217美元。但到2021 11月,比特币价格超过68000美元/枚。

During the period from 2017 to 2018, Bitcoin fell by 83 per cent, from US$ 19423 to US$ 3217. By November, however, Bitcoin was worth more than US$ 68,000.

就在当地时间周五(6月17日),美联储在向国会递交的半年度货币政策报告中警示了稳定币的“结构脆弱性”。报告警告道,稳定币和其他数字资产市场近期出现的暴跌和剧烈波动凸显出这一快速增长领域的结构脆弱性。

On Friday, local time (17 June), the Fed, in its semi-annual monetary policy report to Congress, warned of the “structural fragility” of the stable currency. The report warned that the recent collapse and sharp fluctuations in the stable currency and other digital asset markets highlighted the structural fragility of this fast-growing sector.

报告提示称,没有安全和足够流动资产支持且不受相关监管标准约束的稳定币会将给投资者带来风险,并可能给金融系统造成影响,包括加剧破坏性挤兑的概率。与此同时,支持稳定币的资产,其风险性和流动性缺乏透明度或进一步加剧上述脆弱性。

The report suggests that stable currencies, which are not supported by safe and sufficient liquid assets and are not subject to relevant regulatory standards, can create risks for investors and can have an impact on the financial system, including by increasing the probability of disruptive run-off. At the same time, assets that support stable currencies lack transparency about their risk and liquidity or further exacerbate these vulnerabilities.

(原题为:崩盘!全球虚拟货币大抛售,币圈"雷曼危机"来袭?比特币一度跌穿1.9万美元,170万用户巨头处危险边缘)

(formerly entitled: Collapse! Global virtual currency is being sold, currency rings are being attacked by the Lehman crisis? Bitcoin once fell through $19,000, with 1.7 million users on the brink of danger.)

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论