原创 Carol PANews

Original Carol PANews

作者:Carol,PANews

Author: Carol, PANews

全球最大的资产管理公司BlockRock在6月15日向SEC提交了比特币现货ETF的申请,尽管SEC最早也将在9月2日回应审核情况,但考虑到贝莱德在资产管理行业的全球地位,这一消息仍然被认为是一个重要的信号,预示着比特币和其他加密货币将可能被更多的机构采用。除此之外,近期同样向SEC提交比特币现货ETF申请的知名机构还包括Fidelity、WisdomTree、VanEck、Invesco Galaxy等。随着越来越多机构表明入局意愿,市场对迎来更多合规加密投资产品充满信心。

Block Rock, the world’s largest asset management firm, submitted a Bitcoin spot ETF application to SEC on 15 June, and although SEC will respond to the audit as early as September 2, this message is still considered an important signal that Bitco and other encrypted currencies will likely be used by more institutions. In addition, prominent institutions that have recently also submitted Bitco spot ETF applications to SEC include Fidelity, WisdomTree, Van Eck, and Invesco Galaxy.

机构进场究竟能为加密市场带来什么?为此,PANews旗下数据新闻专栏PAData分析了已经上市的比特币现货ETF、期货ETF和信托基金的交易情况,发现:

What exactly does agency entry bring to the encryption market? To this end, PAData, a data news column under the PANews banner, analyses the transactions of spot ETFs, futures ETFs and trust funds in Bitcoin, which are already on the market, and finds that:

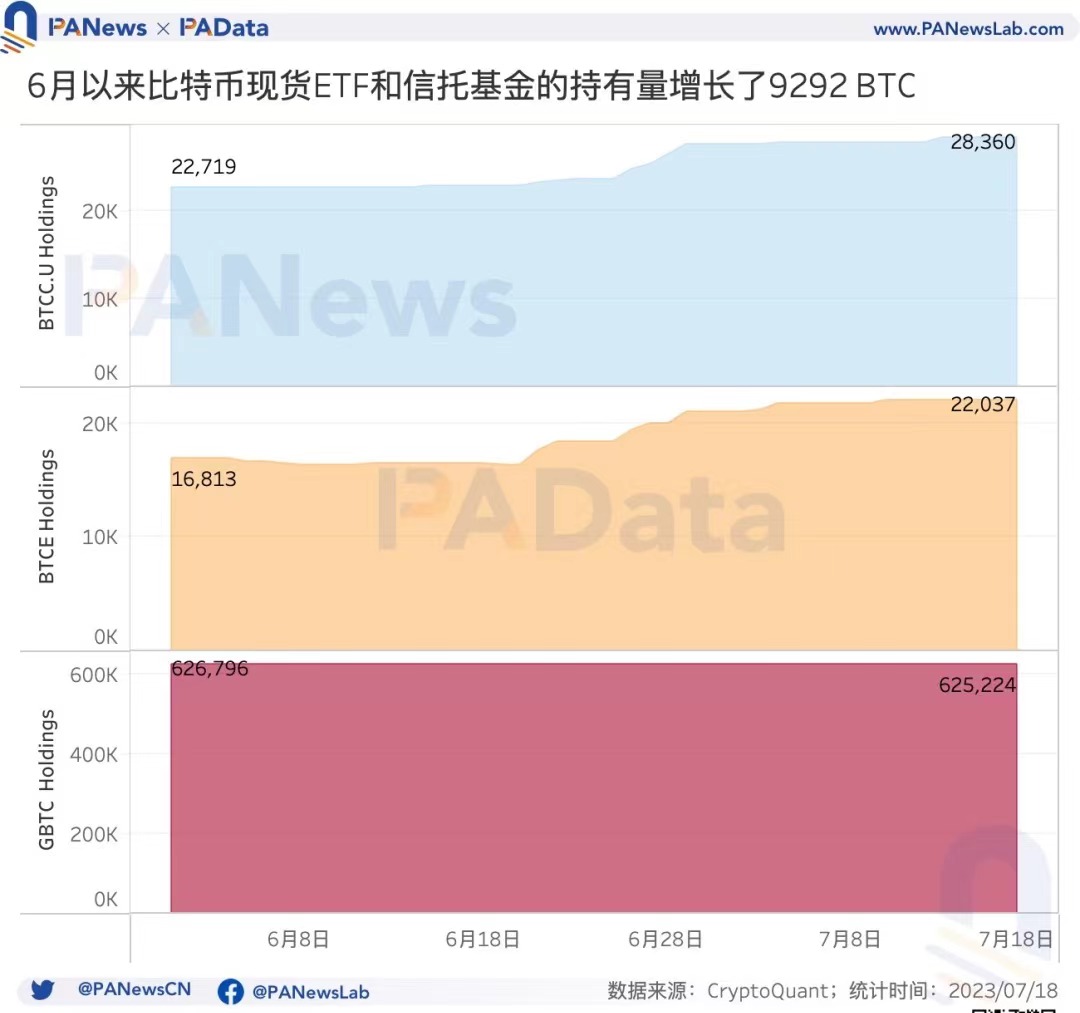

BTCC.U、BTCE和GBTC这3个基金的总持有量约为67.56万BTC(折合202.7亿美元)。自6月以来合计增长了9292 BTC,总体增长趋势较好。

The total holdings of the three funds, BTCC.U, BTCE and GBTC, amounting to approximately 6756 million BTC (equivalent to $20.270 billion), have increased by a total of 9292 BTC since June, with a better overall growth trend.

BITO、XBTF、BTF、BITS和DEFI这5个主要比特币期货ETF管理的总资产已经达到了12.95亿美元。BITO是唯一一个全部配置CME期货合约的期货ETF,其他期货ETF还配置了一定比例的其他资产,如美国国债。

BITO, XBTF, BTF, BITS and DEFI, the five major Bitcoin futures ETF-managed total assets have reached $1,295 million. BITO is the only futures ETF with a full CME futures contract and other futures ETFs with a percentage of other assets, such as the United States Treasury debt.

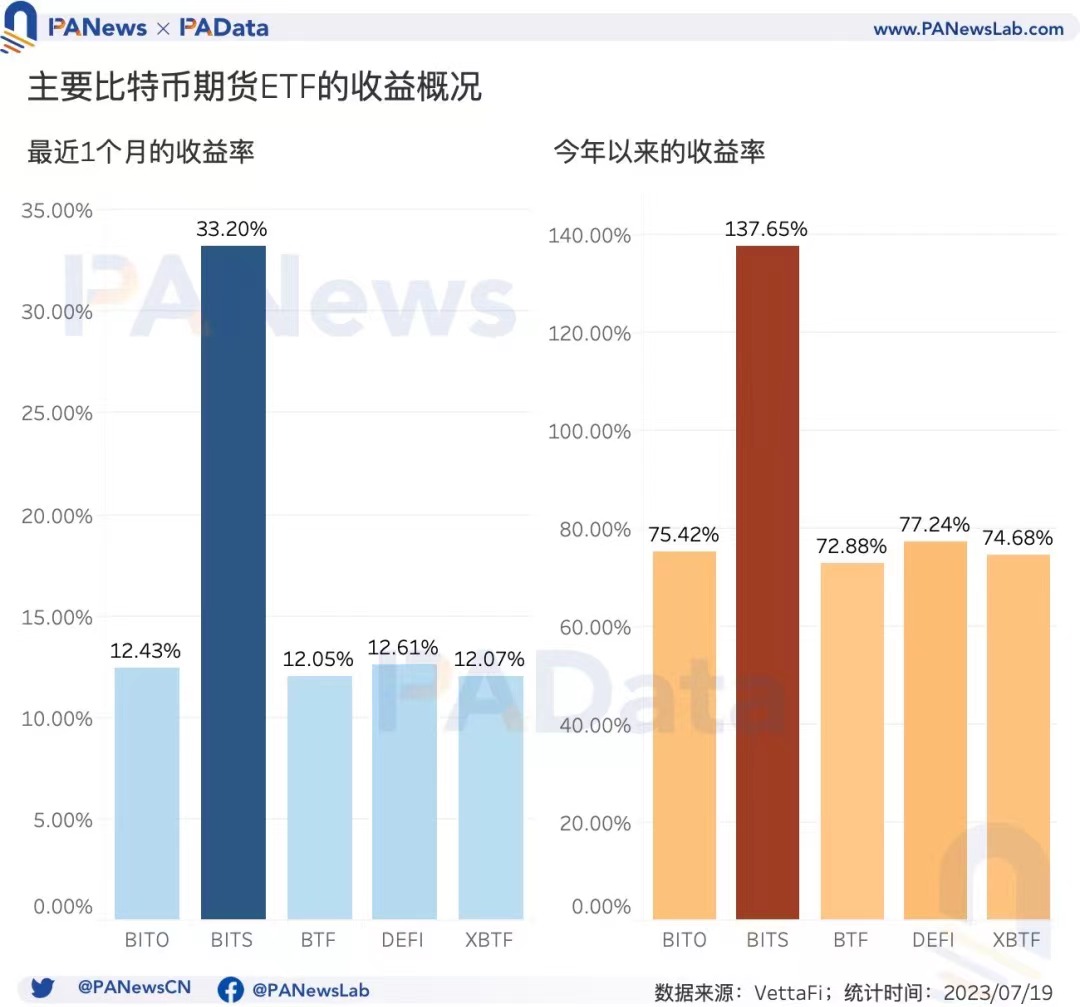

最近一个月收益率最高的是BITS,达到了33.20%,其他都只有12%左右。今年以来,收益率最高的仍然是BITS,达到了137.65%,其他都在74%左右。收益表现好于现货ETF和信托基金。

The highest rate of return in the last month was BITS, which reached 33.20%, and only about 12% for all others. The highest rate of return since this year was BITS, which reached 137.65%, all of which were around 74%. The returns were better than on-the-spot ETFs and trust funds.

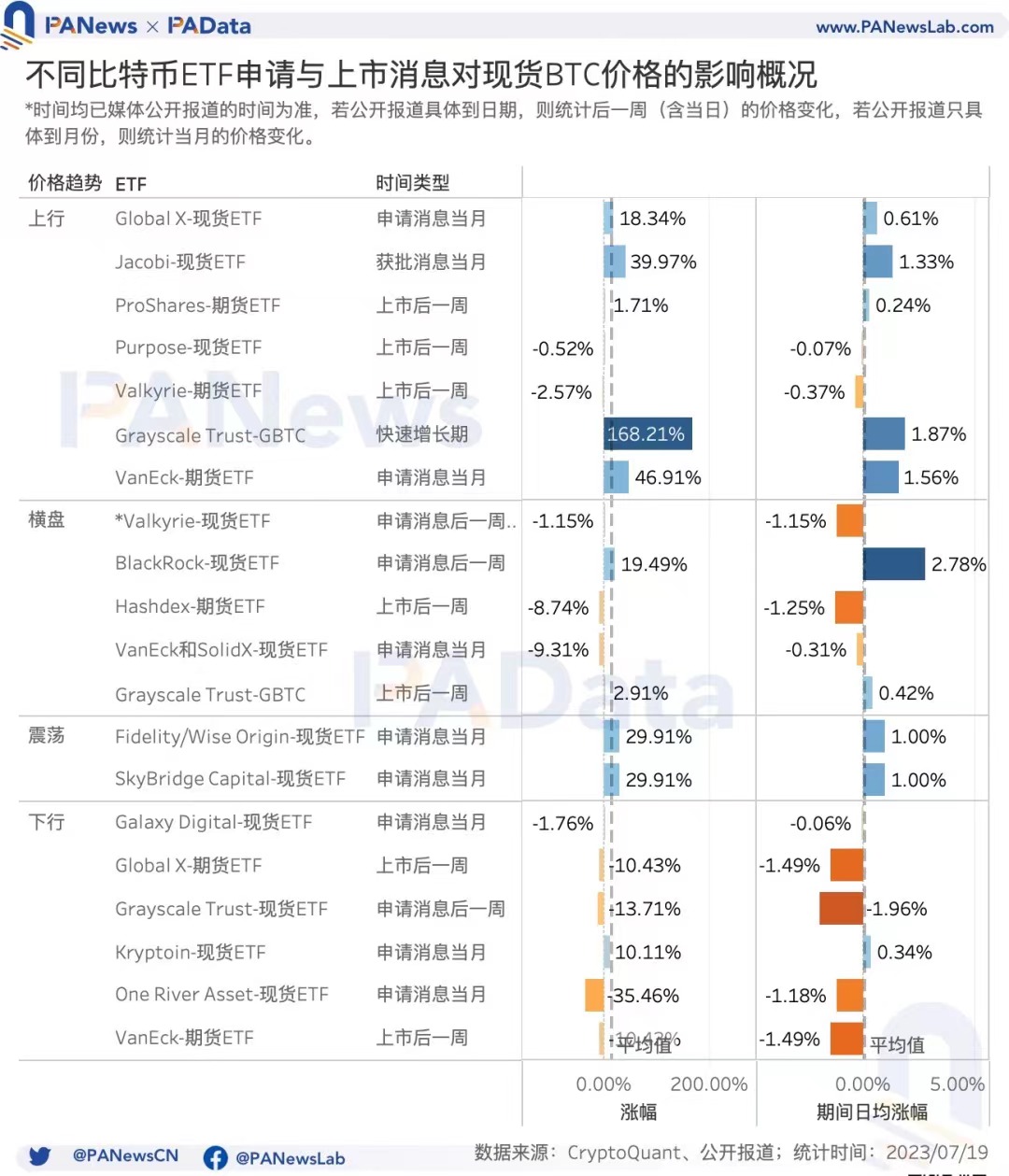

在本次BlackRock申请比特币现货ETF的消息公布后一周内,比特币现货价格日均上涨了2.78%,是统计范围内消息面带来的最大日均涨幅。此前由消息面带来的日均涨幅较高的还有VanEck期货ETF申请当月,日均上涨了1.56%。

Within a week of the release of Black Rock’s application for Bitcoin spot ETF, the average daily spot price of Bitcoin rose by 2.78%, the largest daily increase in the statistical coverage.

机构ETF申请和上市的消息对比特币现货价格的影响可能来自三个方面,一是机构本身的声誉背书;二是申请的ETF类型,现货ETF的申请消息带来的涨幅更大;三是消息发生时比特币的价格趋势,如果申请和上市消息发生于比特币上行趋势中,那么通常能带来一定幅度的价格上涨,如果发生在下行趋势中,那么这些消息通常也不能逆转行情。

The impact of agency ETF applications and listings on the price of the spot price of the currency may arise in three ways: in the form of a reputational endorsement of the institution itself; in the case of applications for the type of ETF, the increase in the information on the application of the spot ETF is even greater; and in the case of news when it occurs, price trends in bitcoin, where application and listings occur in the context of the upward trend of Bitcoin, they usually lead to increases in prices of a certain magnitude, which, if they occur in the downward trend, cannot normally be reversed.

01

比特币现货ETF持有量增长

Bitcoin spot ETF holdings increase

5640 BTC,灰度GBTC场外溢价率回升

5640 BTC, Greyscale GTC out-of-site premium recovery

加拿大投资管理公司Purpose Investment在2021年2月推出了全球首支比特币现货ETF,目前官网显示该ETF包括了4个交易产品,分别是BTCC(用加元购买的,并对冲美元风险)、BTCC.B(用加元购买的,不对冲美元风险)、BTCC.U(用美元购买的,允许投资者以美元持有比特币)、BTCC.J(碳中和),投资者可以在多伦多证券交易所(Toronto Stock Exchange)购买这些ETF,其份额对应实物结算的比特币,是一种用户友好、低风险的加密货币交易方法,而美国的普通用户无法购买该ETF。另一种与现货ETF有些相似的产品是封闭式的信托基金,同样对应了实物比特币,如灰度(GrayScale)在美国发行的,面向合格投资者购买的GBTC。以及德国ETC Group发行的BTCE,BTCE目前可以在两个交易所交易,Deutsche B?rse XETRA(法兰克福证券交易所运行的交易场所), SIX Swiss Stock Exchange(瑞士证券交易所)。

In February 2021, the Canadian Investment Management Corporation, Purpose Investment, launched its first global Bitcoin spot ETF, which is now shown by the Network to include four transactional products, BTCC (purchased in Canadian dollars and at risk to the dollar), BTCC.B (purchased in Canadian dollars, not risk to the dollar), BTCC.U (purchase in United States dollars, allowing investors to hold bitcoins in United States dollars), BTCC.J (carbon neutral), which investors can purchase on the Toronto Stock Exchange, with shares corresponding to the currency of the physical settlement, a user-friendly, low-risk method of encrypted currency transactions, which ordinary users in the United States cannot purchase. Another product similar to the spot ETF is a closed trust fund, which is also a physical bitcoin, such as the GreyScale, which is available to qualified investors on the United States Exchange GBTC.

由于多个数据服务网站仅提供BTCC.U的持有量,因此这里仅不完全统计Purpose现货ETF中的BTCC.U。从BTCC.U、BTCE和GBTC持有的比特币数量来看,截至7月18日,3个基金的总持有量约为67.56万BTC。按照比特币近期30000美元的价格换算,相当于202.7亿美元。其中,GBTC规模最大,持有量为62.52万BTC,BTCC.U和BTCE的持有量都在20万BTC左右。从持有量变化来看,自6月以来,3个基金的持有量合计增长了9292 BTC,总体增长趋势较好,其中仅GBTC的持有量小幅下降了0.25%,BTCC.U和BTCE的持有量则分别上涨了24.83%和31.07%。

Since only BCTC.U's holdings are available on multiple data service websites, only BTCC.U in the Purpose spot ETF is not fully counted. The total holdings of the three funds as at 18 July, as measured by the number of Bitcoins held by BTCC.U, BTCE and GBTC, amounted to approximately 67,560,000 BTCs. This represents $20.270 billion at a recent price of $30,000 in Bitcoin. Of these, the BITCs were the largest, with 62.52 million BTCs, BTCC.U and BTCE holding around 200,000 BTCs. In view of the change in holdings, the combined holdings of the three funds have increased by 9292 BTCs since June, with a better overall growth trend, with only a small decline of 0.25 per cent in BTC holdings, while BTCCs.U and BTCE's holdings rose by 24.83 per cent and 31.07 per cent, respectively.

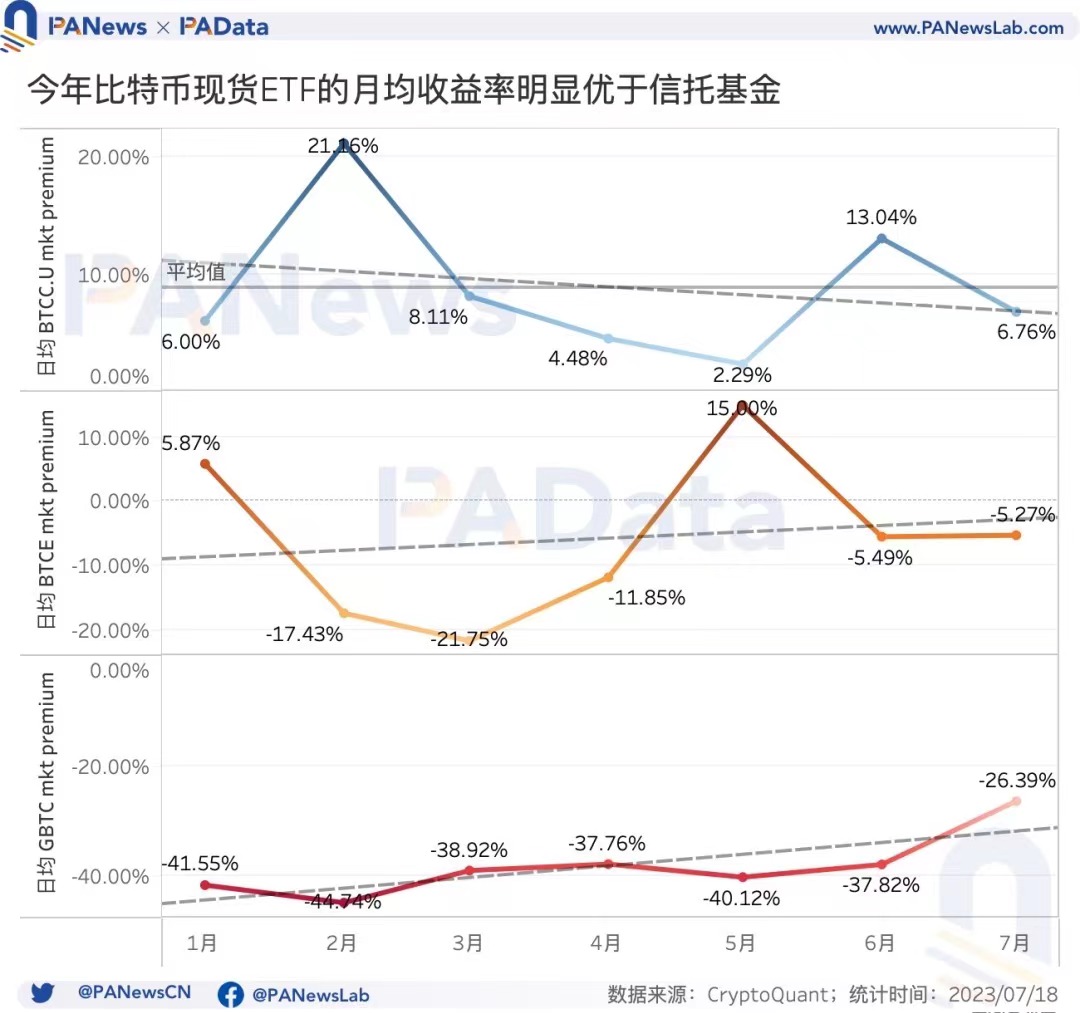

不过,信托基金没有赎回计划,类似“纸黄金”,因此价格往往会与其净资产价值产生明显的价格差异,但现货ETF允许做市商做市,如果有足够的流动性,价格通常不会出现溢价或折价的情况。这种差异充分反映在了3个基金的收益率表现上。

However, trust funds do not have a foreclosure plan, similar to “paper gold”, and therefore prices tend to differ significantly from their net asset values, but spot ETFs allow for marketability and, if there is sufficient liquidity, prices usually do not experience premiums or discounts. This difference is fully reflected in the returns performance of the three funds.

截至7月18日,本月BTCC.U的平均收益率约为6.76%,今年月均收益率均值约为8.84%,明显优于BTCE和GBTC。后两者本月的平均收益率分别为-5.27%和-26.39%,今年的月均收益率则分别为-5.85%和-38.18%,均为亏损状态,但亏损幅度都呈缩小趋势。

As at 18 July, the average rate of return for BCTCC.U for the current month was approximately 6.76 per cent, and the average rate of return for the current month was about 8.84 per cent, which was significantly better than that for BTCE and GBTC. The average rates of return for the latter months were -5.27 per cent and -26.39 per cent, respectively, and the monthly rates of return for the current year were - 5.85 per cent and -38.18 per cent, respectively - both in a state of loss, with a decreasing trend.

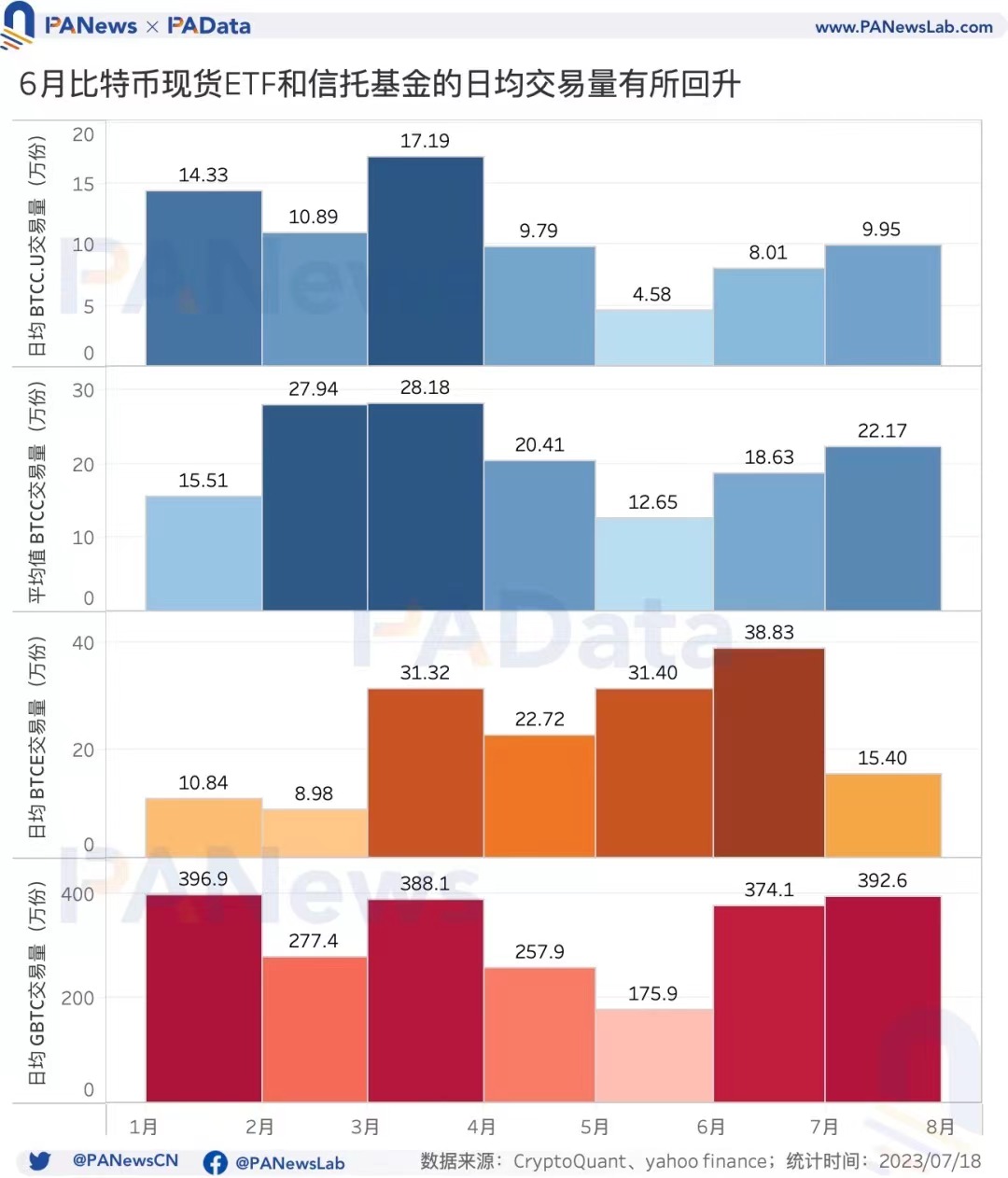

虽然BTCC.U的收益表现更好,但其交易量并不是最高的。截至7月18日,BTCC.U本月的日均交易量只有9.95万份,BTCC本月的日均交易量约为22.17万份,两者合计32.12万份,高于同期BTCE的平均15.40万份,但低于同期GBTC的平均392.6万份。

While BTCC.U's returns were better performing, they were not the highest. As at 18 July, BTCC.U had a monthly average of only 995 million transactions, while BTCC had a monthly average of approximately 22.17 million transactions, a total of 32.12 million, which was higher than the BTCE's average of 15.4 million during the same period, but lower than the GBTC's average of 39.26 million during the same period.

不过,值得关注的是,随着6月更多机构的申请消息被公布,以及BTC价格的稳步回升,这4个基金6月的日均交易量都环比上涨了,其中BTCC.U环比上涨了74.89%,BTCC环比上涨了47.27%,BTCE环比上涨了23.66%,GBTC环比上涨了112.67%。本月至今,BTCC.U、BTCC和GBTC的日均交易量仍然保持了增长势头。

However, it is a matter of concern that, with the announcement of applications from more agencies in June and the steady recovery of BTC prices, the average daily turnover of these four funds rose in June, with the BTCC.U ring ratio rising by 74.89 per cent, the BTCC ring increased by 47.27 per cent, the BTCE ring increased by 23.66 per cent, and the GBTC ring increased by 112.67 per cent.

02

5大比特币期货ETF的总资

5 Grand Bitcoin Futures ETF

产近13亿美元,今年以来收益率均超70%

虽然目前还没有在美上市的比特币现货ETF,但已经有一些在美上市的期货ETF了。截至7月18日,BITO、XBTF、BTF、BITS和DEFI这5个主要比特币期货ETF管理的总资产已经达到了12.95亿美元。其中,由ProShares在2021年10月正式发行的BITO是统计范围内规模最大的期货ETF,总资产达到了11.99亿美元。其次,由VanEck和Valkyrie发行的XBTF和BTF的规模也比较大,总资产分别在3000万美元和4000万美元以上。

Although there is currently no spot ETF for Bitcoin on the United States market, there are some futures ETFs on the United States market. As of 18 July, the total assets managed by the five major ETFs, BITO, XBTF, BTF, BITS and DEFI, had reached $1,295 million. Of these, the BITO, officially released by ProShares in October 2021, was the largest in statistical terms, with a total of $1,199 million.

这些比特币期货ETF追踪的标的通常以芝加哥商品交易所(Chicago Mercantile Exchange,CME)的比特币期货合约为主。其中,规模最大的BITO是唯一一个全部配置CME期货合约的期货ETF,并实行“滚动”期货合约的策略。除此之外,其他期货ETF在配置CME期货合约的基础上,还配置了一定比例的其他资产,比如XBTF和BTF配置了美国国债,BITS配置了其他机构发行的区块链ETF,DEFI配置了现金。

These Bitcoin futures ETF tracers are usually dominated by the Bitcoins futures contract of the Chicago Commodity Exchange (Chicago Mercantile Exchange, CME). Among them, the largest BITO is the only futures ETF with a fully configured CME futures contract and a “rolling” futures contract strategy. In addition, other futures ETFs, based on the configuration of the CME futures contract, have allocated a certain proportion of other assets, such as XBTF and BTF, which have allocated US Treasury bonds, BITS has configured the chain of ETFs issued by other agencies, and DEFI has allocated cash.

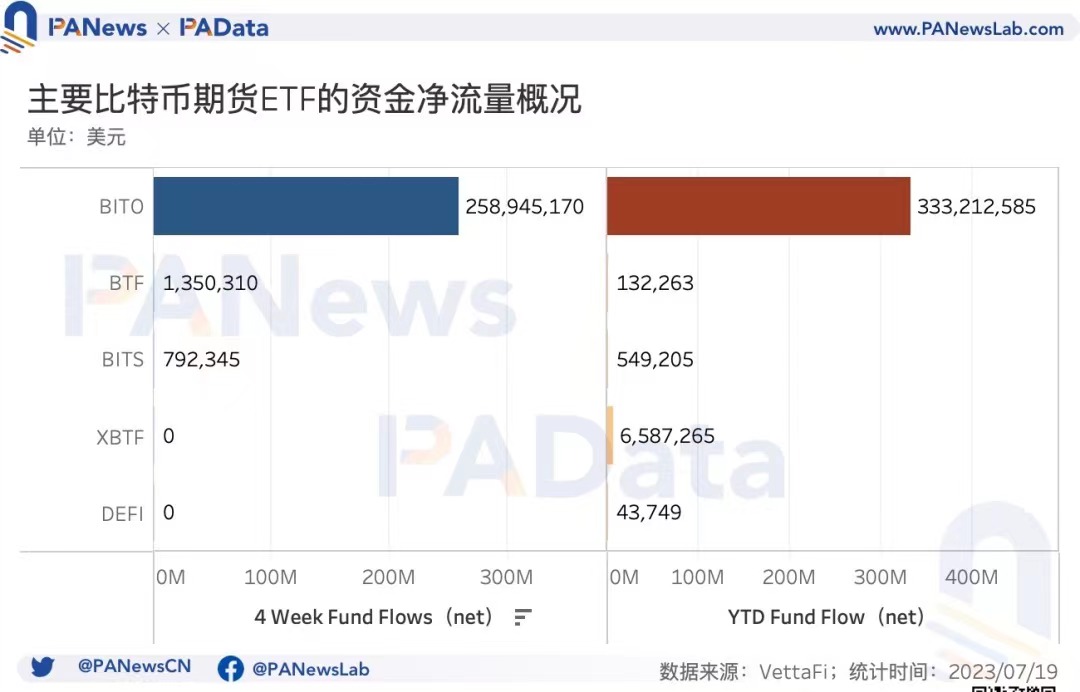

从近期的资金净流量情况来看,BITO的净流入规模也最大。最近一个月,BITO净流入了2.59亿美元。其次,BTF和BITS最近一个月也有少量资金净流入,分别约为135万美元和79万美元。如果把时间周期拉长到今年以来,那么观察范围内的5个比特币期货ETF都有资金净流入,净流入量最高的仍然是BITO,约为3.33亿美元。其次,XBTF今年净流入了658万美元,其他ETF今年的净流入量都比较小。

According to recent net resource flows, BITO’s net inflows have also been the largest. In the last month, BITO’s net inflows have been $259 million. Second, BTF’s and BITS’s net inflows in the last month have been small, amounting to approximately $1.35 million and $790,000, respectively. If the time cycle has been extended to this year, the five bitcoin futures ETFs in the range of observations have received net inflows, with the highest net inflows still being BITO’s, amounting to approximately $333 million. Second, XBTF’s net inflows this year amounted to $658 million, while other ETF’s net inflows this year have been relatively small.

BITO也是这5个比特币期货ETF中日均交易量最高的一个,约为996.91万份,超过本月GBTC日均交易量的153.93%。但其他期货ETF的交易量都不高,BTF约为38.38万份,XBTF约为1.78万份,剩余两个则都不足1万份。

BITO is also one of the five bitcoin futures ETFs with the highest average volume of transactions per day, about 9.9691 million, which exceeds the current month’s average GBTC transactions by 15.93%. But other futures ETFs have not had a high volume of transactions, with BTFs at about 38.38 million, XBTFs at about 17.8 million, and the remaining two at less than 10,000.

总体上,BITO在资金规模、资金流入量和日均交易量方面都远远领先其他比特币期货ETF,但从收益情况来看,BITO却没有领先。

Overall, BITO is well ahead of other Bitcoin futures ETFs in terms of size of funds, inflows and average daily transactions, but in terms of returns, BITO is not.

根据统计,最近一个月收益率最高的是BITS,达到了33.20%,而其他观察范围内的ETF的收益率都只有12%左右。即使把时间周期拉长到今年以来,收益率最高的仍然是BITS,达到了137.65%,而其他观察范围内的ETF的收益率则都在74%左右。

According to statistics, the highest rate of return in the last month was BITS, which reached 33.20%, while in other observations the rate of return was only about 12%. Even if the period of time has been extended to this year, the highest rate of return has been BITS, reaching 137.65%, while in other observations the rate of return has been around 74%.

合理的猜测是,期货ETF的收益率与其配置的资产敞口有较大关系,收益率最高的BITS除了配置比特币期货合约以外,还配置了另一个区块链ETF,其指向了更广泛的加密资产,而不仅仅是比特币,这可能为BITS带来了更高的收益。但总体上,比特币期货ETF的收益表现都要远远好于现货ETF和信托基金。

It is reasonable to assume that futures ETF returns are more related to the exposure of the assets it is configured, and that the highest-return BITS has deployed another block ETF, in addition to the Bitcoin futures contract, which points to a wider range of encrypted assets, not just bitcoins, which may bring higher returns to BITS. But, overall, Bitcoin futures ETFs perform far better than spot ETFs and trust funds.

03

ETF消息面对BTC价格的

ETF News Against BTC Price

影响不一,近期BTC的价格上涨或还与链上基本面有关

机构入场能为加密市场带来丰沛的资金是毋庸置疑的,因此关于机构申请和发行ETF的消息也能总带动比特币现货价格的变化。尽管消息面的影响不是唯一原因,但至少是原因之一,那么这种影响有多大呢? There is no doubt that the agency’s entry into the market can bring money to the encryption market, so information about the agency’s application and distribution of ETFs can always lead to a change in the spot price of Bitcoin. Although the impact of the information is not the only reason, at least one of the reasons, how is that impact? PAData根据公开报道的资料,统计了部分ETF申请和上市消息后一定时间范围内比特币现货价格的变化,如果公开资料在经过交叉验证后能得到具体日期的,则统计消息日期后一周内的价格变化,通常关于期货ETF的上市消息都能具体到日期;如果公开资料在经过交叉验证后只能得到具体月份的,则统计消息当月的价格变化,通常关于ETF申请的时间存在一定的模糊性。为了尽可能在同一个尺度上进行比较,PAData在计算了一定时间范围内比特币价格的日均变化,一周按7天计算平均值,当月按30天计算平均值。 PAData, on the basis of publicly reported information, calculated changes in spot prices for bitcoin within a certain time frame after some of the ETF applications and listings. If the published information becomes available on a specific date after cross-checking, the price changes within a week after the date of the publication usually reach a specific date for the listing of futures ETFs; if the published information becomes available only for a specific month after cross-checking, the price changes during the month of the statistics usually have some ambiguity about the timing of the ETF application. In order to compare as much as possible on the same scale, PAData calculates the average daily changes in bitcoin prices within a given time frame, using an average of seven days per week and 30 days for the same month. 根据统计,在本次BlackRock申请比特币现货ETF的消息公布后一周内,比特币现货价格上涨了19.49%,相当于日均上涨了2.78%,是统计范围内消息面带来的最大日均涨幅。可见市场对机构龙头入场的期待。 According to statistics, within a week of the release of Black Rock’s application for the Bitcoin spot ETF, the price of the Bitcoin spot price rose by 19.49%, equivalent to an average of 2.78% per day, the largest daily increase in the statistical coverage. 其次,在GBTC的其快速增长期(2020年10月至12月)内,比特币现货价格上涨了168.21%,相当于日均上涨1.87%,但GBTC刚上市后一周内,比特币现货价格仅日均上涨了0.42%。 Second, during the GBTC's rapid growth period (October - December 2020), the spot price of Bitcoin rose by 168.21 per cent, equivalent to an average increase of 1.87 per cent per day, but in the week immediately following its entry into the market, the spot price of Bitcoin increased by only 0.42 per cent per day. 其他由消息面带来的日均涨幅较高的还有VanEck期货ETF申请当月,比特币现货价格日均上涨了1.56%;Jacobi现货ETF获批当月,比特币现货价格日均上涨了1.33%;Fidelity/Wise Origin和SkyBridge Capital现货ETF申请当月,比特币现货价格日均上涨了1%。另外,也有一些消息面并没有带动比特币价格上涨,比如最近Valkyrie现货ETF申请消息被报道的当日,比特币现货价格还下跌了1.15%。 Other high average daily increases from sources include Van Eck futures ETF applications, which rose by 1.56 per cent per day in Bitcoin spot prices; Jacobi spot ETFs, which increased by 1.33 per cent per day in Bitco currency spot prices in the month in which they were granted; and Fidelity/Wise Origin and SkyBridge Capital spot ETF, which increased by 1 per cent per day in Bitcoin spot prices in the month in which they were applied. In addition, there are news sources that did not lead to higher prices in Bitcoins, such as the recent news that Valkyrie spot ETF applications were reported, which fell by 1.15 per cent per month in Bitco spot prices. 总的来说,机构ETF申请和上市的消息对比特币现货价格的影响可能来自三个方面,一是机构本身的声誉背书,比如BlckRock这样规模的机构更能刺激市场的信心;二是申请的ETF类型,现货ETF面临的监管压力更大,并且目前还没有一只能获批后在美上市,因此过去普遍的情况是,现货ETF的申请消息带来的涨幅更大;三是消息发生时,比特币的价格趋势。PAData以消息发生时的比特币价格为中点,前后各扩展半年,以观察当时的比特币价格趋势,在这种粗略的观察下,仍然可以发现,如果申请和上市消息发生于比特币上行趋势中,那么通常能带来一定幅度的价格上涨,如果发生在下行趋势中,那么这些消息通常也不能逆转行情。 In general, the impact of agency ETF applications and listings on the price of the spot price of the currency may come from three sources, namely, the reputational endorsement of the institution itself, such as BlockRock, which stimulates market confidence; and from the fact that the applicant's ETF type, which is subject to greater regulatory pressure and which has not yet been approved, has not been listed in the United States, so it has been common in the past that information on the application of the spot ETF has increased significantly; and from the time the news happened, the price of the bitcoin trend. PADATA uses the mid-point of the price of the currency at the time of the news, with successive extensions for six months, to observe the price of the bitcoin at that time. 因此,很难将近期比特币价格的上涨归结于其中一个因素,除了BlckRock带来的利好消息以外,需要注意的是,近期比特币链上交易次数受到BRC-20代币兴起的影响也创下了历史新高。7月18日,比特币链上交易次数达到了58.25万次,较年初的18.74万次增长了210.83%。从趋势来看,5月以后,大多数时间的链上交易次数都在40万次以上,超过50万次也不少。链上交易次数是比特币应用情况的直观反映,通常而言,链上交易次数上涨意味着交易基本面改善,价格很有可能上涨。 As a result, it is difficult to attribute the recent increase in Bitcoin prices to one of these factors. In addition to the good news that Block Rock has brought about, it should be noted that the recent number of transactions in the Bitcoin chain has been affected by the rise of the BRC-20. On 18 July, the number of transactions in the Bitcoin chain reached 58.25 million, an increase of 210.83% compared to the 1874 thousand at the beginning of the year. 消息面的影响是复杂的,无论是现货还是期货,比特币ETF究竟能为市场带来多大规模的资金,以及多大程度的信心,都取决于很多因素。但ETF的申请和获批又与整个市场的发展密不可分,两者应该是相辅相成相互关联的系统。本文的分析仅希望对已发行的比特币ETF做出回顾,并对消息影响做出观察,以为未来的分析提供基础,在此基础上,PAData将会持续关注比特币ETF的交易。 But ETF applications and approvals are inextricably linked to the development of the market as a whole, which should be mutually reinforcing and interrelated systems. The analysis in this paper seeks only to take stock of the distribution of the Bitcoin ETF and to observe the impact of the information in order to provide a basis for future analysis, on the basis of which PAData will keep an eye on the transactions of the Bitcoin ETF. 原标题:《数读比特币ETF:5个期货ETF总资产近13亿美元,比特币受申请消息面影响有多大?》 Original title: Read bitcoinETF: 5 future ETF total assets close to $1.3 billion, and how much of Bitcoin is affected by the application?

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论